ABN or TFN: What’s Right for You? Guide for Australians

Decoding Australia’s Dual Tax Identity System

Figuring out whether to use an ABN or a TFN can be tricky, particularly when your employment situation shifts. It’s a critical distinction to make, whether you’re starting your first job, launching a freelance career, or moving from an employee to a contractor role. This is a common point of confusion for many, from a retail worker thinking about a side gig to a delivery driver for Amazon Flex or Uber Eats who must operate as an independent contractor.

Getting this choice right from the beginning helps prevent major complications down the road. A Tax File Number (TFN) is your private identifier with the Australian Taxation Office for personal income from employment and investments. In contrast, an Australian Business Number (ABN) is a public, 11-digit identifier for your business dealings. The screenshot below shows an example of ABN details on the Australian Business Register.

This public record verifies an entity’s business status, GST registration, and trading name—a fundamentally different purpose from the confidential nature of a TFN. A clear understanding of how these two distinct numbers operate within Australia’s tax framework is essential for every individual and business earning an income.

Tax File Number: Your Personal Financial Passport

Think of your Tax File Number (TFN) as your private financial identifier, issued directly by the Australian Taxation Office (ATO). This unique number is the key that connects you to Australia’s tax and superannuation systems. While its most common use is for employment, a TFN is also necessary for opening most bank accounts without having extra tax withheld from your interest, applying for government support like Centrelink, and lodging your annual tax return.

Failing to provide a TFN to an employer has significant consequences. They are legally required to tax your income at the highest possible rate, which is currently 47% (including the Medicare levy). This results in a substantial reduction in your net pay. The official guidance from the ATO, shown below, underscores the critical role of the TFN in your financial life.

The image highlights that your TFN is a permanent and confidential part of your identity that requires protection. This privacy is a fundamental distinction from a public-facing Australian Business Number (ABN). Your TFN is for your personal use only, securing your financial information from public view.

Australian Business Number: Your Commercial Identity

While your TFN acts as a private identifier for personal tax matters, an Australian Business Number (ABN) functions as your public commercial identity. This unique 11-digit number is issued by the Australian Business Register (ABR) and is fundamental for legitimising your commercial activities, whether you operate as a freelancer, contractor, or sole trader.

Having an ABN is essential for invoicing clients because it shows you are running a business, not simply working as an employee. If you provide services without an ABN, clients are legally required to withhold tax from your payment at the highest marginal rate. This number is a core requirement for anyone participating in commercial enterprise, a growing part of the Australian economy. The number of new business entries climbed from 365,480 in 2020-21 to 436,018 in 2023-24, signalling a significant rise in ABN registrations.

You can publicly search for business details using the ABN Lookup tool on the ABR website, as seen below. This transparency allows anyone to verify a business’s name and GST registration status.

Furthermore, an ABN is a prerequisite for registering for Goods and Services Tax (GST). Registering for GST becomes mandatory once your annual business turnover reaches or is expected to reach the $75,000 threshold.

Strategic Decision Framework: ABN or TFN Analysis

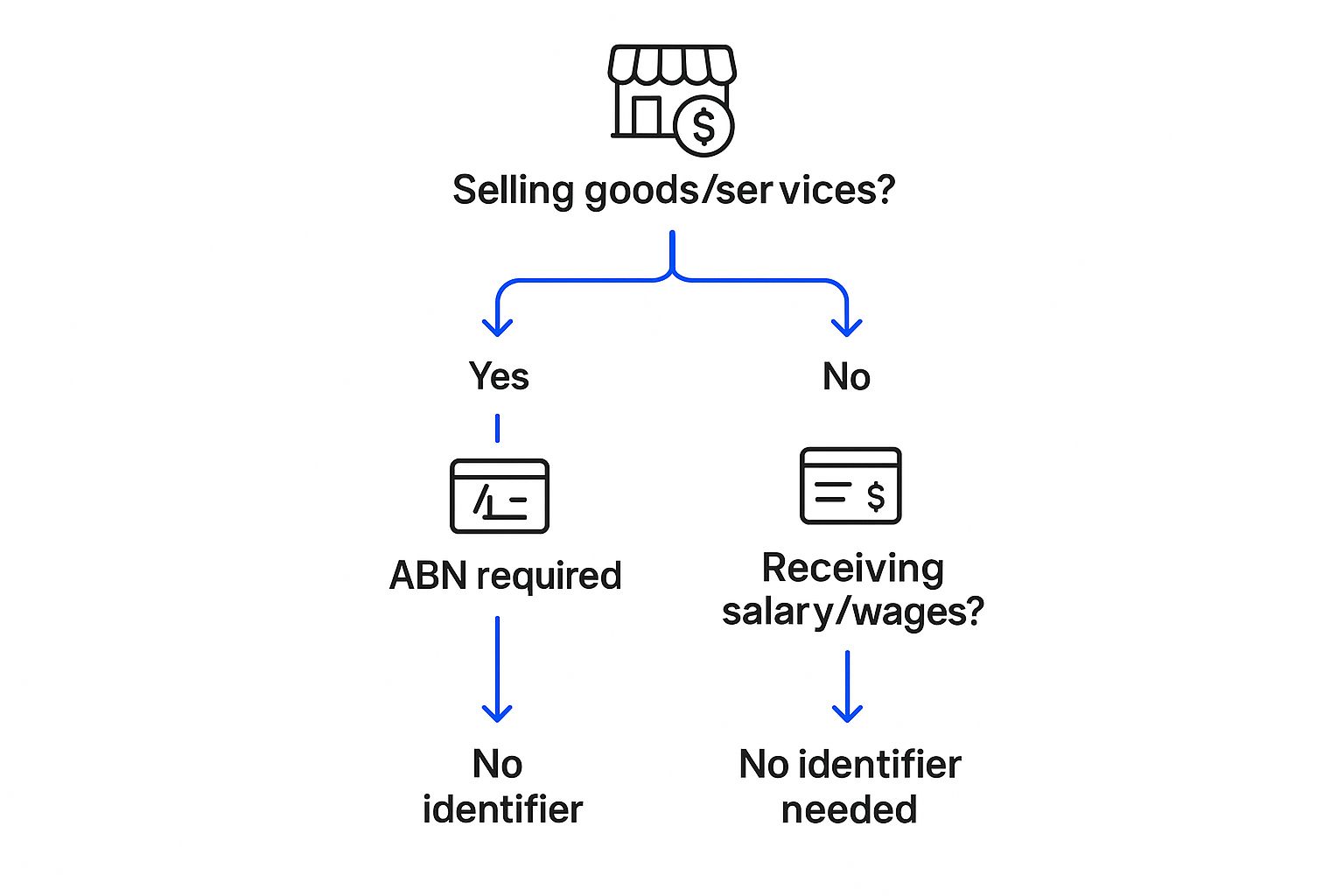

Deciding between an Australian Business Number (ABN) or a Tax File Number (TFN) hinges on the specific nature of your work and how you generate income. The core distinction is straightforward: if you operate as a business by providing goods or services and invoicing for them, an ABN is necessary. Conversely, if you are an employee receiving a salary or wages where your employer withholds tax on your behalf, a TFN is the correct identifier for that employment.

The infographic below offers a clear visual guide for this fundamental choice.

This visual boils the decision down to a single question: are you being paid to complete a job (business activity) or being paid for your time as part of a team (employment)? This logic applies to various work arrangements. For example, a marketing manager who leaves their full-time role to become a freelance consultant must get an ABN to legally bill their clients. Likewise, a retiree who starts a small gardening service is engaging in commerce and requires an ABN.

ABN vs TFN: The Practical Application

To make the most appropriate choice, it’s essential to analyse your working relationship and financial obligations. The following table breaks down the key decision factors, implications, and requirements for both identifiers, helping you determine the best fit for your situation.

ABN vs TFN: Complete Decision Matrix

A practical comparison framework examining key differences, requirements, and implications for different work situations

| Decision Factor | TFN Implications | ABN Requirements | Best Choice For |

|---|---|---|---|

| Work Arrangement | You are engaged by an employer on a permanent, casual, or fixed-term basis. You are considered an employee. | You operate independently, providing goods or services directly to clients or customers. You are considered a business. | TFN: Employees. ABN: Sole traders, freelancers, contractors, partnerships. |

| Income & Payment | You receive regular salary or wages. Your employer handles PAYG withholding. | You issue invoices for completed work and receive direct payments. You are responsible for your own tax. | TFN: Receiving a payslip. ABN: Issuing an invoice. |

| Tax Obligations | Tax is automatically withheld from your pay by your employer. You lodge a personal tax return annually. | You must set aside money for income tax and may need to register for and charge GST. You lodge a business activity statement (BAS) and/or an annual tax return. | TFN: Simplified tax managed by an employer. ABN: Individuals managing their own business tax affairs. |

| Superannuation | Your employer is legally required to pay super contributions on your behalf into your nominated fund. | You are responsible for making your own superannuation contributions from your business income. | TFN: Guaranteed super contributions from an employer. ABN: Self-managed superannuation planning. |

| Legal & Commercial | Primarily used for personal tax and government records. Not used for business transactions. | Essential for business-to-business transactions, claiming GST credits, and avoiding PAYG withholding on payments you receive. | TFN: Personal identification with the ATO. ABN: Public-facing business identification. |

It’s also critical to distinguish an ABN from other business numbers. While an ABN is fundamental for all business structures, it is different from an Australian Company Number (ACN), which is issued only to incorporated companies. Your ABN is directly linked to your TFN, connecting your business activities to your personal tax file with the Australian Taxation Office (ATO). You can find more detailed information on business obligations through various industry resources. Evaluating your work structure against these official definitions will ensure you operate with financial clarity and full compliance.

Managing Dual Registration: When You Need Both

For many Australians, the discussion isn’t about choosing an ABN or a TFN; it’s about the practical need for both. This dual registration is common for individuals who supplement their primary employment with a side business. A classic example is a full-time office worker who also drives for Uber Eats on weekends. In this situation, the Tax File Number (TFN) is linked to their salaried job, where the employer handles tax withholding through the Pay As You Go (PAYG) system.

At the same time, their Australian Business Number (ABN) is used for all income earned as a contractor. When using an ABN, you are responsible for managing your own tax obligations on that income. It’s important to recognise that the Australian Taxation Office (ATO) treats these income streams as distinct, yet both must be declared on your annual tax return.

The ATO is clear that all business income, regardless of whether it’s from your primary operation or a small side activity, must be reported. Holding both identifiers allows you the flexibility to engage in diverse income-generating activities while maintaining full compliance. The key to successfully managing this is meticulous record-keeping to clearly separate your TFN-based employment earnings from your ABN-related business activities.

Application Strategy and Ongoing Compliance Management

Successfully obtaining your identifier requires a distinct approach depending on whether you need a Tax File Number (TFN) or an Australian Business Number (ABN). For Australian residents, securing a TFN is a relatively direct process handled through myGov or an Australia Post office. The key is simply meeting the eligibility criteria.

In contrast, applying for an ABN through the Australian Business Register (ABR) involves a more specific declaration: you must affirm that you are either commencing or currently operating an enterprise. The critical strategic decision is one of timing. While you should apply for a TFN as soon as you’re eligible, an ABN application should only be lodged when you have genuinely started your business activities.

Application Process and Documentation

For both identifiers, applying online is the most efficient method. To get a TFN, you will need to provide standard proof of identity documents, such as a passport or birth certificate. The ABN application builds on this, requiring your TFN to link your business activities directly to your personal tax record.

The Australian Taxation Office (ATO) provides clear guidance on the available application channels, as illustrated below. This ensures that the process is accessible for all eligible individuals and entities.

Once you have your identifier, your compliance obligations begin. A TFN is a lifelong number that requires minimal upkeep. An ABN, however, demands active management. The ATO has the authority to cancel an ABN if it appears inactive, which can happen if you fail to report business income or keep your details updated. Therefore, maintaining your ABN’s active status is crucial for demonstrating that you are still in business.

Critical Mistakes and Compliance Risk Management

Understanding the rules for an ABN or TFN can be tricky, and even small errors can attract unwanted attention from the Australian Taxation Office (ATO). One of the most serious mistakes is sham contracting, where an employer pressures a worker to use an ABN to sidestep legal obligations like superannuation and leave entitlements. This practice is illegal and attracts severe penalties for the employer.

Another frequent issue is failing to declare all income earned through an ABN. Every dollar from a side business or freelance project must be reported on your tax return. Likewise, you must register for GST once your annual business turnover reaches the $75,000 threshold. Overlooking this is a significant compliance breach. Finally, if you don’t meet your lodgement obligations, the ATO can cancel your ABN, which complicates your ability to operate legally.

High-Risk Compliance Scenarios and Prevention Strategies

To avoid financial penalties and legal issues, it’s essential to recognise high-risk situations and know how to manage them. The following table breaks down common compliance pitfalls and provides actionable advice for staying on the right side of the ATO.

Table: High-Risk Compliance Scenarios and Prevention Strategies

Critical mistakes that lead to ATO penalties, with practical prevention and correction approaches

| Risk Scenario | Potential Consequences | Prevention Strategy | Correction Approach |

|---|---|---|---|

| Sham Contracting | Substantial fines for the employer, back-payment of entitlements (super, leave), legal action. | Correctly classify workers as employees or contractors based on ATO guidelines. Seek legal or financial advice if unsure. | Immediately cease the arrangement, correctly classify the worker, and back-pay all outstanding entitlements with interest. |

| Under-reporting Income | Tax shortfall penalties (25-75% of the unpaid tax), interest charges, potential audit. | Use accounting software or a spreadsheet to meticulously track all business income. Reconcile bank statements regularly. | Lodge an amended tax return for the relevant financial year. Voluntarily disclosing before an audit can reduce penalties. |

| Failing to Register for GST | Liability for GST on all sales from the date you were required to register, plus penalties and interest. | Monitor your turnover each month. Register for GST as soon as your turnover is projected to exceed the $75,000 threshold. | Register for GST immediately. Prepare and lodge all overdue Business Activity Statements (BAS) and pay the outstanding GST. |

| Inactive ABN Cancellation | Inability to legally invoice for work, potential loss of business identity, complications with business banking. | Lodge all required tax returns and activity statements on time, even if reporting zero income. | Re-apply for the ABN if you are still entitled to it. You will need to provide evidence that you are running an enterprise. |

Understanding these scenarios is the first step toward effective risk management. Proactive compliance is always less costly and stressful than correcting mistakes after they’ve been flagged by the ATO. If you find yourself in one of these situations, addressing it quickly and transparently is the best course of action.

Disclaimer

The information on this website is for general informational purposes only and should not be considered financial, taxation, or legal advice. While we strive for accuracy, Nanak Accountants does not guarantee the completeness or reliability of the content. Laws and regulations change over time, and we recommend consulting a qualified professional before making any financial or business decisions. Nanak Accountants is not liable for any loss or consequences arising from reliance on this information. For personalised advice, please contact Nanak Accountants directly.