Not everyone can write off their laptop come tax time. The Australian Taxation Office (ATO) has specific rules about who’s eligible. Whether you’re an employee or running your own show as a sole trader, the key is showing your laptop is a work tool, not a personal gadget.

Think of your laptop like a tradie’s hammer. If that hammer is essential for the tradie to do their job and earn a living, it’s deductible. The same idea applies to your laptop. If it’s crucial for your work and how you bring in income, you’re on the right track.

For employees, the laptop needs to be directly tied to your work responsibilities. Just occasionally checking work emails from your couch doesn’t really cut it. The ATO looks for substantial work use. If you regularly work from home, create reports, or participate in virtual meetings, you’re much more likely to meet the requirements.

If your employer provides a laptop, you generally can’t claim a personal one. However, if you buy a second laptop specifically for work and your company doesn’t reimburse you for it, claiming it might be a possibility.

Sole traders usually have less trouble claiming a laptop on their taxes. If the laptop is used to run your business, bring in money, and handle your core business operations, you can likely claim it. This could include things like client communication, sending invoices, marketing your business, or working on product development.

But even if you’re a sole trader, you need to split the claim based on how much you use it for business. So, if your laptop sees 70% business use and 30% personal use, you can only claim 70% of the related expenses. This means meticulous record-keeping, which we’ll get into later.

So, you’re thinking about claiming your laptop as a tax deduction? Smart move! But before you get too excited, it’s important to understand the rules. Not every laptop purchase is a write-off. The Australian Taxation Office (ATO) wants to see that your laptop is genuinely contributing to your income.

Think about it this way: are you using your laptop for core work tasks? Things like preparing reports, managing projects, or running your business operations? Those everyday activities virtual meetings, accessing work systems remotely, client databases, invoicing, these are exactly what the ATO considers legitimate work-related usage.

Let’s look at some examples. Taking online professional development courses directly related to your current job? That could be deductible. Researching a potential career change? Probably not. It also depends on your situation. If you’re an employee and your employer provides a laptop, claiming your personal one is a bit trickier. But if you’re a sole trader, using your laptop for essential business operations is often a valid deduction.

This section will help you figure out which laptop activities you can deduct and, importantly, how to keep good records. Accurate record-keeping is essential. Heaps of Australians claim work-related expenses, including laptops, and the ATO is serious about making sure these claims are legitimate. Want to learn more? Check out the ATO website for work-related expenses for the full rundown. Trust me, knowing how to back up your claims is key to a smooth tax time.

So, you splashed out on a new laptop for work and now it’s tax time. Wondering how to claim it? It all boils down to how much you spent, which is where the instant asset write-off and depreciation come in. Let’s break down these two methods so you can maximize your tax return while keeping the ATO happy.

If your laptop cost less than the instant asset write-off threshold (currently $20,000 for the 2024-25 financial year), you’re in luck! You can claim the full business-use portion the same year you purchased it. This translates to a bigger tax refund upfront.

For example, let’s say your new laptop set you back $1,500, and you use it 80% for work. You can claim $1,200 right away. Pretty sweet, right? Just remember, this threshold can change, so it’s always a good idea to double-check the latest ATO guidelines.

What if your laptop cost more than the instant asset write-off limit? Then you’ll need to depreciate it. Depreciation basically spreads your claim over the laptop’s effective life – usually a few years for business laptops.

Imagine your high-powered laptop cost $25,000, and you use it 75% for business. While that means $18,750 is work-related, you can’t claim it all at once. Instead, you’ll claim a portion each year based on the ATO’s depreciation rules.

Picking the right method is crucial for claiming your laptop expenses correctly. Understanding these options will help you get the most out of your deductions without any headaches from the ATO.

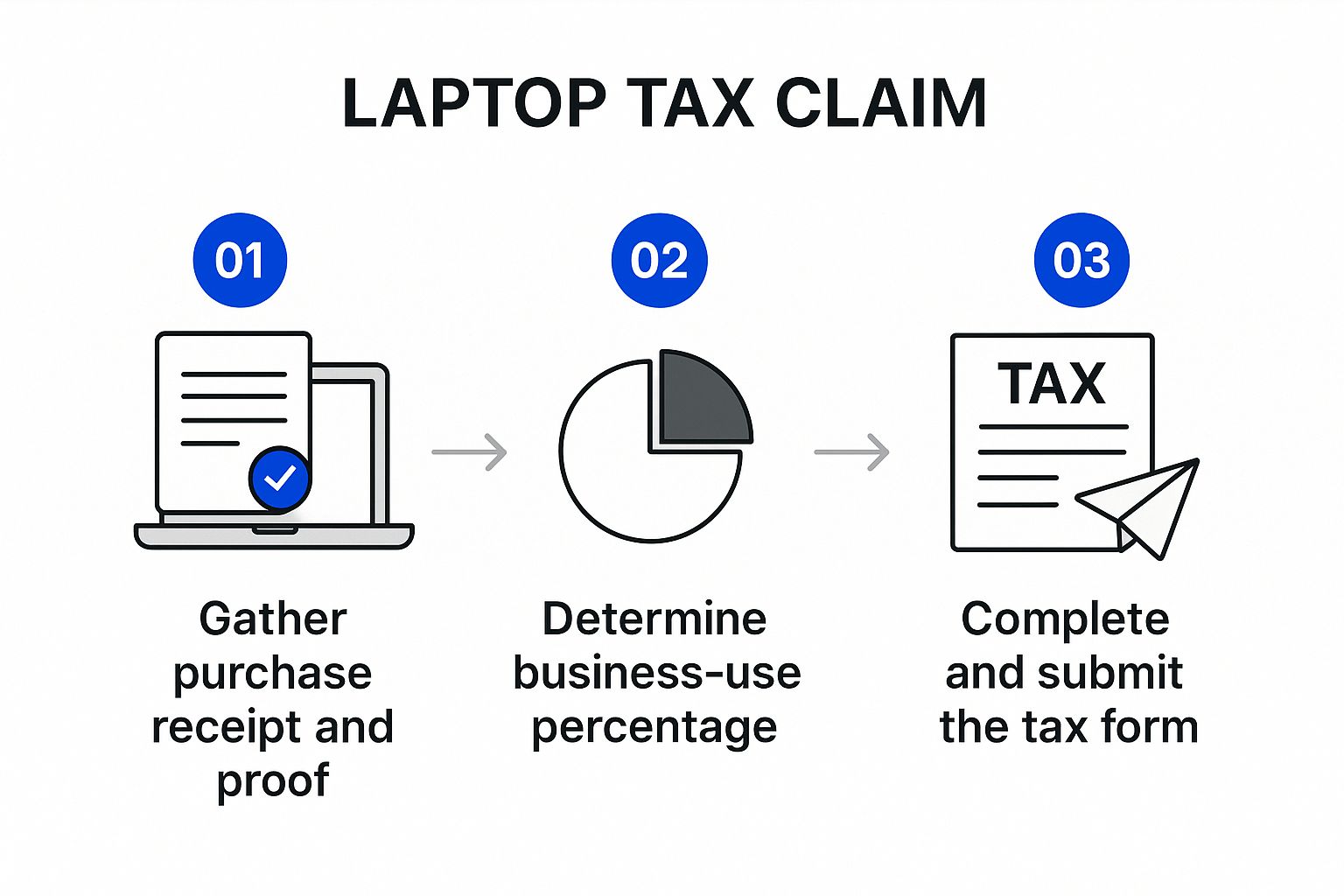

Figuring out your business use percentage for your laptop is key when it comes to claiming it on your Australian taxes. The ATO wants solid proof, not guesses. This means tracking how you use your laptop, creating a representative sample of that use, and keeping detailed records. The infographic below gives you a visual guide to the three main steps for filing a laptop tax claim with the ATO.

As the infographic shows, claiming your laptop comes down to gathering the right documents, calculating your business use accurately, and submitting the correct paperwork. This step-by-step method helps ensure a smooth and compliant tax filing process.

A four-week diary gives the ATO a good representation of your typical laptop use. This diary should include every activity, the time spent on it, and whether it was for work. Think client calls, project work, and even admin tasks, these all fall under business use.

For example, let’s say you use your laptop for work 40 hours out of a total 50 hours of use over those four weeks. Your business use is then 80%. You’ll apply this percentage to your laptop’s cost to figure out your deduction. Remember, good record-keeping is essential.

Claiming a laptop on tax in Australia has some specific rules about deductions. For example, laptops costing less than $300 and used more than 50% for work can be fully deducted. Pricier laptops, however, are depreciated over time.

To help you understand the different approaches, let’s look at a comparison table:

Laptop Tax Deduction Methods Comparison: This table compares immediate deduction versus depreciation methods based on laptop cost and business use percentage.

|

Laptop Cost |

Business Use % |

Claiming Method |

Deduction Amount |

Years to Claim |

|---|---|---|---|---|

|

$250 |

60% |

Immediate Deduction |

$250 |

1 |

|

$250 |

40% |

Not Eligible |

$0 |

N/A |

|

$1500 |

80% |

Depreciation |

(Calculated based on depreciation method) |

Multiple |

|

$1500 |

20% |

Not Eligible |

$0 |

N/A |

This table illustrates how the deduction amount and the timeframe for claiming can change based on the cost of your laptop and how much you use it for work. It’s important to note that the depreciation amount for more expensive laptops isn’t a fixed number and depends on the chosen depreciation method.

You can learn more about claiming laptops and other work tools at the ATO website. This careful approach will help you maximize your claim and stay on the right side of the ATO.

Thinking about claiming just your laptop? Don’t stop there! Lots of other tech goodies can help you lower your tax bill. Think about your mouse, keyboard, that trusty laptop bag, and even the software you use daily. If these are primarily for business, they could mean extra deductions. The trick, just like with your laptop, is showing they’re essential for your work, not just fun extras.

Ever thought your laptop bag could be a tax deduction? Well, if you’re constantly on the move for client meetings, a good bag protecting your tech and keeping you organized is arguably a business expense. Similarly, an ergonomic mouse preventing wrist strain during those long work hours directly impacts your ability to earn. These are perfect examples of how seemingly personal items can become legitimate deductions when used for work.

Software subscriptions are fundamental deductions for many businesses. Consider services like Microsoft 365 or accounting software such as Xero. If these tools directly impact your income, you can generally deduct them based on the percentage of business use. Maintaining thorough records, such as invoices and usage logs is crucial for supporting your claims.

Having solid documentation is especially important if you work from home or operate a small business. For instance, since July 2022, the ATO’s fixed rate for home office expenses is $0.67 per hour, which includes general expenses like energy and internet. However, for specific costs such as laptop depreciation, the actual cost method is required. Properly categorizing and documenting everything helps in maximizing deductions and staying compliant with the ATO.

To provide a clearer understanding of eligible claims, refer to the table below:

Deductible Laptop Accessories and Software: Common laptop-related items eligible for work-related tax deductions

|

Item Category |

Examples |

Deduction Method |

Documentation Required |

|---|---|---|---|

|

Hardware Accessories |

Mouse, Keyboard, Monitor, External Hard Drive, Laptop Bag, Printer, Webcam, Headphones |

Depreciation or Immediate Deduction (depending on cost) |

Receipts, Usage Logs (showing business use percentage) |

|

Software |

Microsoft 365, Xero, Adobe Creative Cloud, Anti-virus Software |

Deduction based on business-use percentage |

Invoices, Usage Logs |

|

Other |

Repairs, Warranties |

Deduction based on business-use percentage |

Receipts, Repair Invoices |

This table offers a foundation for considering all potential deductions related to your laptop setup. Remember, keeping detailed records is the key to a smooth tax season!

Keeping accurate records is the best way to handle any questions the ATO might have about your laptop claim. A simple receipt just won’t cut it. You need a solid paper trail that shows how much you use your laptop for work and backs up how you calculated your deduction.

What’s the ATO looking for? Think of it like building a case for your laptop’s role in your business. Here’s what you’ll need:

Invoices: The original invoice showing the date and how much you paid for your laptop.

Usage Logs: A detailed diary or logbook covering a four-week representative period. This log should include dates, times, and a description of what you were working on.

Software & Accessory Receipts: Retain receipts for work-related software or accessories, such as Microsoft Office or a laptop bag.

Staying organized doesn’t have to be a chore. Here are some practical tips to make it easier:

Digital Copies: Scan or take photos of your receipts and invoices. Cloud storage is a safe and convenient way to keep them organized.

Detailed Descriptions: Be specific in your usage log. Instead of just writing “work,” try “preparing client presentation for XYZ company.” This level of detail makes all the difference.

Regular Updates: Don’t wait until tax time! Regularly updating your usage log keeps things accurate and reflects your actual work habits.

By following these simple steps, you’ll build a solid record-keeping system that meets ATO requirements and gives you peace of mind. This careful approach shows that your claim is legitimate and ensures you’re ready if the ATO needs more information. For more complicated situations, it’s always a good idea to talk to a qualified accountant. They can help you navigate the details of claiming your laptop and ensure you’re doing everything by the book.

Claiming your laptop as a business expense can put some welcome cash back in your pocket. But, be warned, there are common mistakes that can attract unwanted attention from the ATO. One of the biggest traps is claiming 100% business use when you also use your laptop for personal things. Be honest with yourself and calculate the actual percentage you use it for work.

Another slip-up that often trips people up? Poor record-keeping. The ATO needs more than just a receipt to be convinced. A detailed usage log showing exactly what work-related activities you were doing on your laptop is essential. Think of it as a diary for your device!

Don’t even think about claiming expenses that your employer has already reimbursed – that’s a big no-no. It’s called double-dipping, and the ATO doesn’t look kindly on it. And, make sure you’re up to speed on depreciation rules. Overclaiming here can also raise red flags.

Finally, tread carefully around the instant asset write-off threshold. Getting this wrong is a surefire way to invite an audit. Before hitting submit, double-check your claim meticulously, or even better, chat with a tax professional. They can make sure everything is squeaky clean and aligned with ATO guidelines.

Need a hand navigating these tricky tax waters? Nanak Accountants & Associates can offer expert advice and ensure your claim is accurate and compliant. Learn more about how we can help with your tax return.

The information on this website is for general informational purposes only and should not be considered financial, taxation, or legal advice. While we strive for accuracy, Nanak Accountants does not guarantee the completeness or reliability of the content. Laws and regulations change over time, and we recommend consulting a qualified professional before making any financial or business decisions. Nanak Accountants is not liable for any loss or consequences arising from reliance on this information. For personalised advice, please contact Nanak Accountants directly.