Let’s chat about GST – the Goods and Services Tax. It’s a 10% value-added tax tacked onto most goods and services sold in Australia. Every business owner needs to get their head around it, but working out if you need to register can be a real headache.

For most businesses, the magic number is $75,000. This is the annual turnover threshold. If your business earns, or you expect it to earn, more than this in any 12-month period, you’ll need to register for GST. It’s like a speed limit – go over, and you’re playing by different rules. This threshold covers all your business-to-consumer sales within Australia.

For example, say you run an online store selling handmade candles. If you project your sales to top $75,000 in the coming year, it’s time to get familiar with GST registration in Australia. This threshold is key to understanding when it becomes a legal must-do for your business.

The Australian GST registration threshold is AUD 75,000. This means any business expecting an annual turnover above this amount must register. This applies to all Australian B2C sales and is calculated over a rolling 12-month period. Non-profits have a higher threshold – AUD 150,000. But there are exceptions. Taxi and ride-sharing services, for instance, must register no matter their turnover. Learn more about Australian GST

Now, here’s a curveball. Even if you’re below the threshold, you can register voluntarily. Seems odd, right? But it can be a savvy move for some. I was talking to a boutique owner in Melbourne the other day who registered early, even though her sales were below the threshold. Why? It boosted her professional image with bigger clients and let her claim back GST on business expenses.

So, why is claiming back GST a good thing? When you’re registered, you can claim input tax credits. This means you can recoup the GST you’ve paid on business expenses, which can really add up, especially if you have significant business purchases.

Also, certain sectors, like taxi and ride-sharing, require gst registration melbourne regardless of turnover. Even if a driver makes less than $75,000, they still need to register. Non-profits, as mentioned, have a different threshold at $150,000. Knowing where your business fits is the first step in getting your head around GST registration in Australia.

Hitting that $75,000 mark might feel like a milestone, but it’s not the only thing that triggers GST registration. Understanding these details can make a big difference to your business’s bottom line.

Let’s summarize the different thresholds in a handy table:

GST Registration Thresholds by Business Type

| Business Type | Registration Threshold | Mandatory/Optional | Special Conditions |

|---|---|---|---|

| Most Businesses | $75,000 | Mandatory (above threshold), Optional (below threshold) | |

| Non-Profits | $150,000 | Mandatory (above threshold), Optional (below threshold) | |

| Taxi & Ride-Sharing | N/A | Mandatory | Regardless of Turnover |

This table breaks down the GST registration requirements for different types of businesses. As you can see, while the $75,000 threshold is the standard for most, certain industries have unique rules. This highlights the importance of understanding the specifics for your business type.

Let’s be honest, GST registration can sound like a real pain. But once you get past the initial jargon, it’s actually pretty straightforward. I’ve helped several businesses through this, from tech startups to cafes, and I’m here to share the inside scoop to make it easy for you too. We’ll walk through the process, using real-world examples (like the tech startup that registered in a single afternoon and the cafe owner who strategically timed their registration). We’ll also cover everything from document preparation to navigating the Australian Business Register portal, and even share some timing tips for maximizing cash flow.

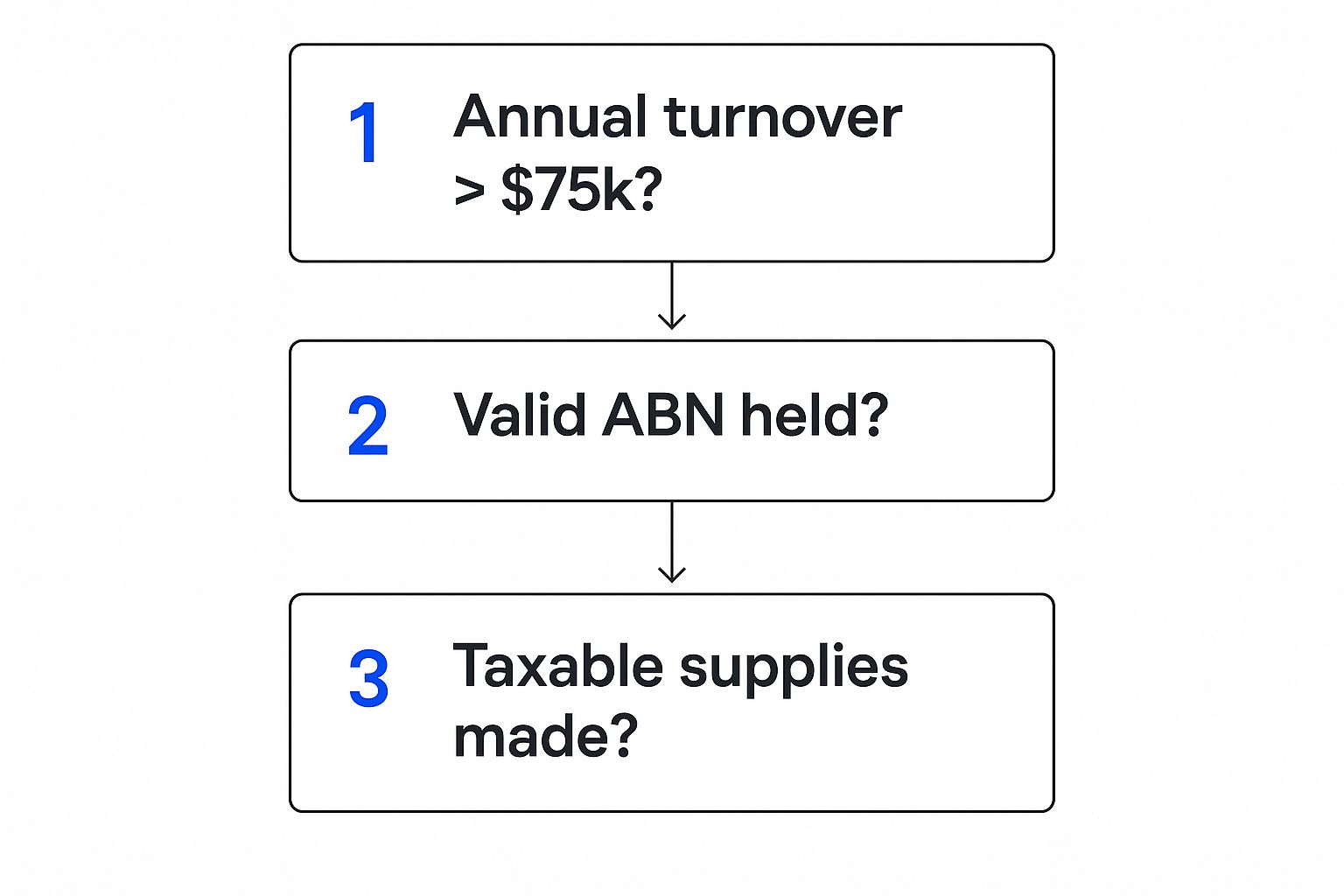

This handy infographic shows the key things you need to consider: annual turnover, ABN, and the type of goods or services you’re selling.

As you can see, these three factors are essential in figuring out if you need to register. You’ll need to tick all three boxes to be required to register.

First up, you’ll need an Australian Business Number (ABN). It’s basically your business’s official ID. You can grab one through the Australian Business Register (ABR) website. It’s surprisingly quick – sometimes you’ll get it on the spot. This same website is where you’ll register for GST later.

Now for the paperwork. For GST registration in Australia, you’ll need your ABN, details about what your business does, and your financial records. The exact documents you’ll need will depend on your business structure (sole trader, company, etc.). But no matter what, getting your financial statements in order is a great first step. It’s like packing for a trip—being prepared saves you stress later on.

With your ABN and documents sorted, head back to the ABR website. Now you’re ready to link your ABN to your GST registration. Double-check your ABN details—even a small typo can cause delays. I saw this happen firsthand with a tech startup. A single incorrect digit in their ABN set them back two weeks!

Timing your GST registration strategically can make a big difference to your cash flow. For seasonal businesses, syncing your registration with your busiest time can be really advantageous. I helped a cafe owner in Brisbane do this. She timed her registration for the summer months, which were her peak season. This allowed her to offset the extra GST she collected against the GST she paid on her increased expenses, resulting in better cash flow management.

Realistically, GST registration melbourne can take a few days to a couple of weeks. The key is providing accurate information and responding quickly to any requests from the ATO. The faster you can get your documents together, the smoother the process. This is where professional GST registration services can be a real lifesaver. They can handle the trickier bits for you, ensuring everything’s done correctly and efficiently. They’re also a great resource for post-registration advice to keep you on the right side of the ATO.

GST registration. It can feel like a bit of a maze, right? The truth is, the path isn’t the same for every business. Knowing what’s what for your specific structure can save you a whole lot of hassle. So, let’s break down how different business types tackle GST registration in Australia.

For sole traders, GST registration is really personal. It’s all tied to your individual income. I was chatting with a freelance graphic designer in Melbourne the other day, and she mentioned how confusing she initially found the whole thing. But once she realised it was linked to her projected earnings, it all made sense. If you’re a sole trader, hitting that $75,000 turnover mark means you have to register.

So, think of it this way: if your income is looking like it’s going to hit that magic number, best to get prepared!

Partnerships have a slightly different game to play. It’s the combined turnover of all the partners that determines your GST obligations. Let’s say you and a friend run a catering business in Sydney. Even if you each individually earn less than $75,000, if your combined income is over the threshold, you’re on the hook for GST.

This joint responsibility is key, so make sure you and your partners are on the same page and planning together.

Companies and trusts often have more moving parts. I recently worked with a property development company on the Gold Coast, and their GST registration was a whole different ball game compared to a smaller business. Higher turnover, more complex transactions—they needed expert help.

If you’re in this situation, don’t hesitate to look into professional GST registration services. Trust me, they can make the whole process much smoother.

Things can get even more intricate with structures like family trusts. Imagine a family trust running a cafe in Melbourne and an online store. They need to look at the total turnover from all their activities – everything combined – to figure out their GST obligations.

It’s a more nuanced situation than a business with a single focus. Make sure you have a clear picture of your total income across all ventures.

Operating across state lines? Pay extra attention! The GST threshold applies to your total Australian turnover, no matter where your business is based or where you sell. If you’re based in Perth and selling products nationally, it’s your overall income that counts.

This can sometimes trip people up, so keep your financial records organized and up-to-date.

If you’re a startup expecting rapid growth, think about GST early on. Even if you’re below the threshold now, project your future turnover. A tech startup in Brisbane expecting to quickly surpass $75,000 might choose to register voluntarily. This lets them claim input tax credits sooner and sets them up for good GST habits from day one.

Planning ahead like this is a smart move and can really pay off down the line.

Getting your GST registration sorted in Australia is a big win, but it’s really just the first step. Think of it like finally getting your driver’s license—the real learning begins once you’re out on the road solo. Similarly, managing your ongoing GST obligations is where the rubber meets the road in business. Let’s break down what actually changes in your day-to-day operations, using real Aussie businesses as examples.

Now that you’re registered, you’ll need to lodge Business Activity Statements (BAS) with the ATO. This is basically a regular catch-up with the tax office, a bit like a financial check-in. The frequency depends on your business structure; it could be monthly or quarterly. I was chatting with a retailer in Darwin who initially found the whole BAS process pretty overwhelming. The paperwork and deadlines felt like a mountain to climb. But they quickly found their rhythm using Xero, a cloud-based accounting software that calculates GST and generates BAS reports automatically. Now it’s just another routine task. You can find a handy guide on lodging your BAS on our BAS lodgement page.

Correctly adding GST to your invoices is essential. The GST amount must be clearly displayed as a separate line item. While it seems straightforward, things can get a little tricky when you factor in discounts, international transactions, or varying GST rates. I recently helped a Perth-based consultancy streamline their invoicing by integrating their accounting software (they use MYOB) with their CRM. This automatically adds the correct GST to every invoice, saving them heaps of time and minimizing errors.

Remember those input tax credits? Here’s where they shine. You can claim back the GST you’ve paid on legitimate business expenses, which can significantly reduce your overall GST bill. The key takeaway here is meticulous record-keeping. The Darwin retailer I mentioned earlier learned this the hard way. Initially, they missed out on claiming hundreds of dollars in input tax credits simply because their expense records were a mess. Now, they diligently track everything, making sure they claim every cent they’re entitled to.

The goal is to make GST a natural part of your business operations, not a constant headache. Finding systems that work with you, not against you, is crucial. The Perth consultancy discovered that cloud-based software was a game-changer. They can access their financial data from anywhere, generate reports instantly, and easily collaborate with their accountant. Whether you’re a small business navigating registration for business or a larger company looking into gst registration for company procedures, having the right tools and processes makes all the difference. If you feel overwhelmed, don’t hesitate to reach out to professional. They can provide personalized guidance and set you up for success.

Heads up, Aussie business owners! Some pretty big GST registration changes are on the way, and they could have a real impact on how you run things. The government is talking about raising the GST registration threshold from $75,000 to $250,000. This isn’t just a minor tweak; it’s a potential shift in the playing field, affecting everything from your business structure to how you manage your cash flow. For many businesses currently registered, this might mean they no longer need to be.

This change will hit different businesses in different ways. So, the big question is: should you rush to register now under the current rules, or wait and see what happens? Let’s break down the reasons behind these proposed changes, the likely timeline, and the practical steps you can take now to prepare. We’ll even share some insights from business owners and accountants who are already figuring this out.

The government’s goal here is to simplify the GST system and lighten the load for smaller businesses. For those operating between the current and proposed thresholds, GST registration can be a real headache. This change could free up their time and resources, letting them focus on growing their business and doing what they do best. Plus, aligning the threshold for businesses and non-profit organizations makes the whole system more consistent and easier to grasp.

This proposed jump from $75,000 to $250,000 is a big deal, and it’ll have a ripple effect. Planned to kick in on July 1, 2025, it aims to streamline things by bringing the threshold for businesses and non-profits into line. Interestingly, the Parliamentary Budget Office (PBO) reckons that about 95% of businesses currently between those two thresholds might actually stay registered so they can keep claiming GST credits. Check out the PBO’s take on things for more details.

Right now, the target date is July 1, 2025. But it’s always a good idea to keep an ear out for any official updates or changes to this timeline from the ATO. The transition period might also bring some specific rules and procedures for businesses already registered. For example, those falling below the new threshold might need to deregister or adjust their accounting practices.

So, what can you do right now? First off, take a good look at your current turnover and project your earnings for the next few years. If you’re close to that $75,000 mark, think carefully about whether registering now is the right move for you. If you expect significant growth that will push you over the new $250,000 threshold, you might want to register voluntarily, even if you’re below the current limit. This way, you can start claiming those input tax credits earlier and get a solid GST management system in place. Also, chatting with your accountant or a GST registration specialist is essential. They can provide personalized advice based on your unique situation. Melbourne businesses might find specialized gst registration Melbourne services particularly helpful for navigating local regulations.

Navigating these changes means being proactive and understanding how they’ll affect your bottom line. By taking these steps now, you’ll be prepared for a smooth transition and set yourself up for continued success. Whether you’re looking into gst registration for a company or just figuring out your obligations as a sole trader exploring gst registration for business, staying informed is key.

Let’s be honest, GST registration in Australia can feel like navigating a minefield. I’ve chatted with so many business owners who’ve tripped up along the way, and believe me, you don’t want to repeat their expensive mistakes. Think of me as your friendly guide, here to steer you clear of the common pitfalls.

One of the biggest traps is simply missing the registration deadline. I was talking to a retailer in Sydney the other day who got hit with a hefty penalty. They thought they were safely under the $75,000 turnover threshold, but a sudden spike in sales pushed them over the limit. They ended up paying way more than the GST they owed, all thanks to late fees. The lesson here? If you’re even close to that $75,000 mark, register early. Trust me, it’s much less stressful than playing catch-up (and paying extra!). Accurate turnover projections are your best friend here.

Another common mistake? Messing up the GST on invoices. A service provider in Brisbane told me about their early days, accidentally charging GST on exempt items and undercharging on others. Talk about an accounting nightmare! It damaged their client relationships too. Make sure your invoice software is set up correctly and that everything is in line with ATO guidelines. Getting this right from the beginning will save you a world of pain down the line.

Don’t forget about those precious input tax credits! A Melbourne startup I know nearly lost thousands in potential credits because their record-keeping was, well, let’s just say it wasn’t their strong suit. Receipts were everywhere, and there was no system for tracking expenses. They learned the hard way that meticulous record-keeping is non-negotiable. Good accounting software designed for Australian GST can be a lifesaver here. Think of it as automating your peace of mind.

GST registration isn’t a set-and-forget thing. Ongoing compliance is key. Little slip-ups can snowball into big problems. Forgetting your ABN on invoices, lodging your BAS late, or incorrectly classifying goods and services – these things can trigger penalties. It’s like forgetting to signal when you change lanes—seems small, but can cause major headaches. Establish good habits and use reliable accounting software from the outset. It’ll make compliance much less daunting.

By learning from these common mistakes, you can confidently navigate the world of GST registration in Australia and avoid the financial potholes that catch so many business owners off guard. Remember, staying informed and getting professional advice when you need it is always a good idea.

Ready to simplify your GST registration and ongoing compliance? Contact Nanak Accountants and Associates today. We’ll help you navigate the complexities of GST, making sure you avoid costly errors and maximize your financial success. Learn more about how Nanak Accountants and Associates can assist you with GST registration Australia.

The information on this website is for general informational purposes only and should not be considered financial, taxation, or legal advice. While we strive for accuracy, Nanak Accountants does not guarantee the completeness or reliability of the content. Laws and regulations change over time, and we recommend consulting a qualified professional before making any financial or business decisions. Nanak Accountants is not liable for any loss or consequences arising from reliance on this information. For personalised advice, please contact Nanak Accountants directly.