Before diving into the how-to of lodging your Business Activity Statement (BAS) online, let’s talk about getting prepped. Seriously, I’ve seen firsthand how crucial this is. A little organization can turn a potential two-hour accounting nightmare into a breezy 15-minute task. Start by gathering your key documents: sales invoices, purchase receipts, and anything related to GST and PAYG.

Think of it like this: you wouldn’t head to the airport without your passport, right? Your BAS essentials are similar: tax invoices, expense receipts, and those all-important payroll records. Other documents, like bank and credit card statements, are helpful supporting info, but knowing the difference between essential and helpful can save you a lot of time and hassle.

Now, about staying organized. A good system is a game-changer. Imagine rummaging through a messy pantry for a specific spice – frustrating, isn’t it? Your BAS paperwork is no different. I recommend creating a dedicated folder (physical or digital) for each BAS period. Then, use subfolders for categories like sales, purchases, and payroll. It’s a simple system, but trust me – it’s a lifesaver when it comes time to fill out those ATO forms. Many bookkeepers swear by this method!

Here’s a peek at the myGov login page:

This dashboard is your gateway to various government services, including the ATO’s online services for lodging your BAS. Getting comfortable with this portal is a key part of the online lodgement process.

Finding the right tools and resources can significantly impact how smoothly your BAS lodgement goes. In Australia, we’re fortunate to have a few different ways to lodge online. You can go directly through the ATO’s online services or enlist the help of a registered BAS or tax agent. A tax agent can even help you secure deadline extensions – a real lifesaver when things get hectic.

To help you decide which route is best for you, I’ve put together a quick comparison table:

BAS Lodgement Options Comparison

| Method | Best For | Features | Cost | Support Level |

|---|---|---|---|---|

| myGov | DIY approach | Direct access to ATO services, relatively straightforward | Free | ATO online resources |

| ATO Business Portal | Businesses with more complex needs | More comprehensive features, reporting tools | Free | ATO online resources and business support |

| Tax Agent | Businesses needing expert guidance, complex situations | Handles lodgement for you, can offer advice and planning, can obtain extensions | Agent fees apply | Personalized advice and support from your agent |

This table highlights the main differences between the various lodgement methods. Choosing the right method depends on your individual circumstances, but having these options provides flexibility for businesses of all sizes.

For more detailed information, check out this helpful resource: Discover more insights on BAS lodgement options. With the right setup and a clear understanding of your options, you’re well on your way to conquering your BAS with confidence.

Let’s be real, the ATO’s online systems can be a bit of a head-scratcher. Having walked countless businesses through the ins and outs of both myGov and the ATO Business Portal, I’ve learned a thing or two. Sole traders often find myGov the easiest route for lodging their BAS online, but the Business Portal can be a better fit for others. Knowing which platform works best for your specific needs is the first hurdle.

This screenshot shows the ATO’s dedicated business portal, a one-stop shop for various tax-related tasks. See how clean and organized it is? The resources are readily available, which is a welcome change from myGov’s sometimes confusing navigation.

Once you’ve chosen your platform, setting up your dashboard is like organizing your toolbox. Keep the tools you use most within easy reach. Bookmarking key pages within the ATO portal and customizing your view will save you precious time every quarter. For example, bookmarking the BAS lodgement page means no more clicking through endless menus.

Getting familiar with the login process and any shortcuts is also a game-changer. Think saved login details or specific browser settings. This is a lifesaver when deadlines loom. Understanding the platform’s quirks is key to lodging your BAS efficiently. For instance, knowing the difference between “view” and “download” for your BAS can save you from a mountain of unnecessary paperwork.

Speaking of efficiency, lodging a Business Activity Statement (BAS) online is now standard practice for Australian businesses. The ATO reported over 14.1 million individual tax return lodgments in the 2024 financial year, a 3% increase. This shows the growing reliance on digital platforms like those used for BAS lodgement. Discover more insights on ATO statistics. These platforms, including the Business Portal and MyGov, offer a simple and efficient way to lodge your BAS digitally. But, sometimes things don’t go as planned. Knowing when to ask for help is important. If you run into technical hiccups or confusing instructions, reach out to the ATO or a tax professional. It’s always better to be safe than sorry, especially when it comes to your finances.

Missing a BAS deadline can really sting your wallet. Trust me, I’ve seen it happen – a relaxed attitude towards these deadlines can end up costing businesses thousands in penalties and interest. So, let’s break down these monthly, quarterly, and annual lodgement schedules. We’ll use real-world examples to demonstrate how understanding these dates can actually boost your bottom line.

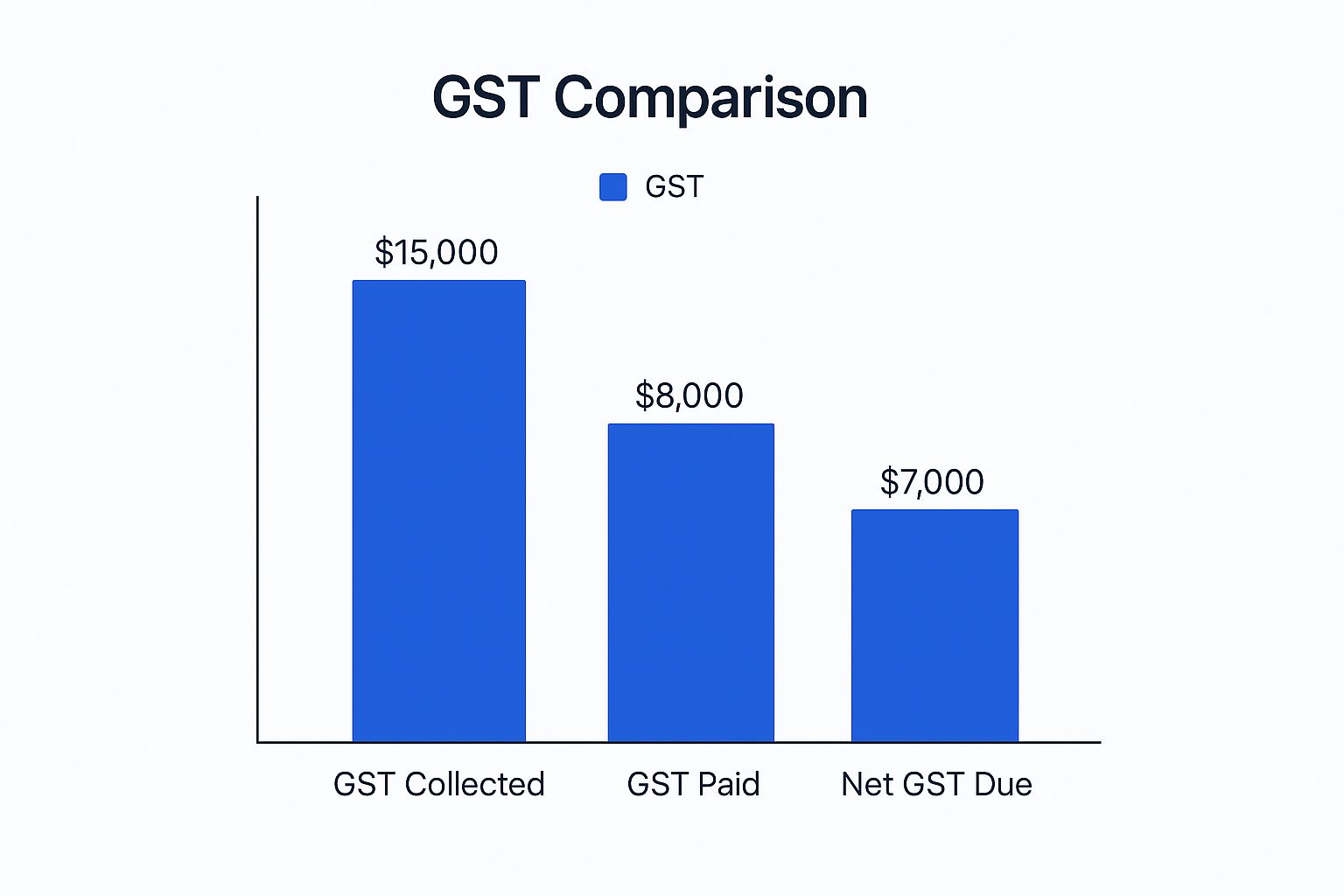

This infographic illustrates the relationship between GST Collected, GST Paid, and your Net GST Due:

Imagine you collected $15,000 in GST, but paid $8,000 on business expenses. This leaves you with a net GST due of $7,000. Visualizing it like this makes it much easier to grasp when you’re lodging your BAS online.

Now, let’s dive into those crucial due dates. It’s not always as straightforward as marking the 28th on your calendar. Weekends and public holidays can throw things off. For instance, if the 28th falls on a Saturday, your deadline rolls over to the following Monday. Being aware of these little quirks can save you a lot of hassle and potential penalties. Plus, there are often hidden grace periods that the ATO doesn’t always shout about, so staying informed is definitely worthwhile.

Monthly, quarterly, and annual BAS lodgement schedules are essential for Australian businesses. Monthly lodgers have a due date on the 21st of the following month. This regular rhythm helps maintain consistent financial oversight and compliance.

Quarterly lodgers have slightly different deadlines to remember. These are typically:

Annual lodgers usually have until October 31st of the following year. However, if you’re lodging with your tax return, the tax return due date takes precedence.

To help you visualize these dates, take a look at the BAS Due Dates Calendar below. It provides a comprehensive overview of all the deadlines, making it easy to plan and avoid any last-minute scrambles.

BAS Due Dates Calendar

Complete calendar of BAS due dates for monthly, quarterly and annual lodgers

| Period | Monthly Due Date | Quarterly Due Date | Annual Due Date | Payment Due |

|---|---|---|---|---|

| January | February 21st | February 21st | ||

| February | March 21st | March 21st | ||

| March | April 21st | April 28th | April 28th | |

| April | May 21st | May 21st | ||

| May | June 21st | June 21st | ||

| June | July 21st | July 28th | July 28th | |

| July | August 21st | August 21st | ||

| August | September 21st | September 21st | ||

| September | October 21st | October 28th | October 28th | |

| October | November 21st | November 21st | ||

| November | December 21st | December 21st | ||

| December | January 21st | January 21st | ||

| Annual | October 31st | October 31st |

Keeping track of these different schedules is vital for avoiding penalties and keeping your financial operations running smoothly. Remember, this table is a general guide, and specific circumstances might apply, so always double-check with the ATO website.

Here’s a snapshot of the ATO’s BAS due dates page – a super helpful resource. See how clearly they lay out the different lodgement schedules? It makes confirming your specific deadlines a breeze. But effective BAS deadline management involves more than just knowing the dates; it’s about having a system. More on that later!

This is where it gets real – actually filling out your BAS. Having looked at thousands of these things, I can tell you exactly where people get stuck (and how you can avoid those painful, expensive mistakes). Let’s start with the GST section.

G1, Total sales, is a classic. I’ve seen businesses include GST when they shouldn’t, and leave it out when they should. Those pesky “mixed supplies” – part taxable, part not – can also be a headache. Don’t worry, we’ll get to those. What happens when your accounting software gives you numbers that don’t quite match the BAS form? I’ll show you what to do.

This screenshot shows a sample BAS form. See the different sections for the various tax components? Understanding how these relate to what you do in your business is key to lodging correctly. Getting each section right is important, as mistakes can lead to penalties.

Next are the purchase sections. G10 and G11 can be tricky, but I’ll share the insider tips that prevent the most common errors. It’s all about correctly recording your GST credits and making sure you’re claiming what you’re entitled to – and not a cent more. Remember, the ATO’s online system automatically works out your net GST payable or refundable based on the figures you enter.

For example, if your total sales (G1) are $50,000 and your GST on purchases (G10) is $10,000, your net GST will be $40,000. Simple, right?

Now for PAYG. We’ll look at some real-life payroll situations that often cause confusion. Think irregular employees, contractors who might actually be employees – it can get messy fast. But confidently tackling W1 and W2, even when your payroll isn’t straightforward, is absolutely doable with the right approach. I’ll walk you through it.

It’s all about understanding the rules and having a good system. One system I’ve found helpful is to keep a separate spreadsheet for your PAYG calculations. This lets you double-check everything before putting it into your BAS, minimizing the chance of errors.

Before you hit that “submit” button, let’s talk verification. Experienced bookkeepers have a checklist – and I’m going to share it with you. It’s not just about the numbers themselves; it’s about the relationships between them. There are specific mathematical checks you can do that will often highlight errors before they become a real problem.

For example, your total sales should line up with the income you’ve reported elsewhere. Another check is to make sure your claimed GST credits match your purchase records. These little checks can save you a huge amount of hassle later on. Remember, knowing how to lodge your BAS online isn’t just about filling in the blanks – it’s about being accurate and avoiding those costly slip-ups.

You’re almost there! Lodging your Business Activity Statement (BAS) online is just around the corner. But this final stage is crucial – it’s where attention to detail really pays off. I’ve helped countless businesses navigate BAS submissions, and believe me, those final checks can make all the difference between a smooth lodgement and a real headache. Think of it like a pre-flight check before takeoff – you don’t want any surprises mid-air!

Here’s a glimpse of the myGov login page, your starting point for online BAS lodgement.

This dashboard is your access point for a whole range of government services, connecting you to everything you need to manage your BAS effectively. Once you’re logged in, head over to the Australian Taxation Office (ATO) section to access the online BAS lodgement service.

Anyone who regularly lodges a BAS online develops a review process – and it’s much more than just a quick scan. It’s about really understanding what those confirmation screens are telling you. Are there any warnings or messages that need attention? Is your payment information accurate? Have your bank details changed since your last lodgement? These seemingly small things can prevent significant problems later.

I remember one client who almost submitted their BAS with the wrong bank account listed for payment. They’d switched banks and forgotten to update their details. Catching that tiny error before hitting submit saved them a missed payment and a whole lot of stress.

Now, let’s talk payments. Setting up a direct debit is a lifesaver. It’s like putting your BAS payment on autopilot – it’s taken care of automatically, so you don’t have to remember every due date. Just make sure your details are current and the funds are available. Also, if you’re experiencing cash flow challenges, explore the ATO’s payment options. They often have arrangements that can help you avoid late fees and penalties.

Once you’ve submitted your BAS, keep an eye out for a confirmation email from the ATO. This is your proof of lodgement, and it includes important details about your payment. It usually arrives within a few business days. If you don’t see it, check your spam or junk folder first, then contact the ATO if it’s still missing.

Mastering online BAS lodgement puts you in control of your business’s tax obligations. A thorough review process ensures accuracy and helps you avoid potential problems down the line. With a good system in place, you’ll be confident and ready to manage your BAS like a pro, keeping your business running without a hitch.

Even with the best preparation, tech can be a fickle friend. I’ve seen it all – online BAS disasters that would make your hair curl. It happens. So, I’ve built up a troubleshooting arsenal over the years, and I’m happy to share it. We’ll cover those panic-inducing login fails right before the deadline, forms that freeze mid-entry, and error messages that look like they’re written in Klingon.

First up: browser settings and internet connection. Seriously, using a supported browser (like Chrome or Firefox) and having a decent internet connection solves about 90% of technical glitches. It’s like checking your car has gas before you drive across the country. And, while we’re on the topic, have a backup internet plan. Can you tether to your phone? Knowing your alternative routes can save you when the clock is ticking.

This screenshot shows the ATO’s help and support page. See all those contact options, from phone support to online resources? Familiarizing yourself with them beforehand is a game-changer.

Having those resources handy is like having a trusted mechanic on speed dial – invaluable when you need a quick fix or some expert advice. It can save you a world of pain.

Sometimes, DIY just isn’t enough. Knowing the right ATO number and having your information ready is crucial. And don’t be shy about asking for a transfer if the first person you speak to can’t help. I’ve done it countless times. You need to get to the person who can actually solve your problem.

But there’s a fine line between persistence and banging your head against a wall. If you’ve been grappling with the same issue for an hour, step away. Breathe. Try again later with a fresh perspective. Sometimes, a little distance is all you need.

Is it you, or is it the ATO’s system? Figuring this out early can save you a mountain of frustration. If you’re getting an error about an incorrect field, double-check your entries. Maybe you transposed a number or missed a decimal point. Easy fix. But if the website itself is behaving erratically, it’s probably a technical issue on their end.

Taking screenshots of error messages is a good habit. It’s like gathering evidence – helpful if you need to escalate the issue. And if online lodgement is a no-go and deadlines are breathing down your neck, remember your alternatives. Can your tax agent lodge for you? Knowing how to lodge a BAS online is fantastic, but having backup strategies is essential. Sometimes, the old-fashioned ways are the most reliable.

Congratulations on lodging your BAS online! But lodging your BAS is a bit like learning to ride a bike—you wouldn’t just ride once, would you? The real value comes from making it a regular habit, a sustainable system. The most successful businesses treat BAS not as a dreaded quarterly chore, but as a routine part of their financial operations.

Think of it as a monthly financial health check. Regular bookkeeping helps catch small issues before they become big headaches. By consistently reviewing your income and expenses, you can correctly categorize transactions for GST, ensuring you’re claiming all eligible credits and reporting your liabilities accurately. It’s preventative maintenance for your business’s financial engine.

Your bookkeeping system also needs to grow with your business. A simple spreadsheet might have worked when you were starting out, but it probably won’t cut it when you’re dealing with hundreds of invoices each month. Choosing the right accounting software, like Xero or MYOB, is crucial for handling increasing transaction volumes.

Each BAS you lodge is a snapshot of your business’s financial health. Reviewing this data quarterly reveals important trends. Are your sales seasonal? Are expenses rising faster than income? This kind of insight can inform important decisions, like adjusting your pricing or streamlining operations. It’s like having a financial roadmap for your business.

Your quarterly review is also a good time to rethink your BAS frequency. If your business has grown significantly, switching from quarterly to monthly lodgements might be beneficial. This can help you stay on top of your obligations and manage your cash flow more efficiently.

Don’t be afraid to ask for help. Seriously, it’s often a smart move. If you’re spending hours each month struggling with your bookkeeping, or if you’re unsure about how to handle certain transactions, it might be time to consult a professional. A good accountant or bookkeeper can lift that burden from your shoulders and ensure your BAS is accurate and submitted on time. Think of it as an investment in peace of mind. If you’re using a registered tax or BAS agent, you may get an extended due date under the ATO’s lodgement program

Your BAS isn’t just about compliance. It’s a treasure trove of information. Learning to interpret this data can lead to better decisions throughout the year. Spotting seasonal patterns can inform your marketing strategy. Understanding your expense breakdown can highlight areas for cost savings. Your BAS can be a powerful business intelligence tool – so use it! Knowing how to lodge your BAS online is just the first step. Turning your BAS process into a tool for growth? That’s where the real magic happens.

Ready to streamline your BAS and unlock your business’s potential? Nanak Accountants and Associates offers expert advice and tailored solutions for all your tax and accounting needs. Contact us today to learn how we can simplify your BAS, minimize your liabilities, and help you achieve sustainable growth.

The information on this website is for general informational purposes only and should not be considered financial, taxation, or legal advice. While we strive for accuracy, Nanak Accountants does not guarantee the completeness or reliability of the content. Laws and regulations change over time, and we recommend consulting a qualified professional before making any financial or business decisions. Nanak Accountants is not liable for any loss or consequences arising from reliance on this information. For personalised advice, please contact Nanak Accountants directly.