Maximizing your small business tax deductions is essential for boosting profitability. This listicle reveals ten often-overlooked tax deductions specifically for Australian small businesses. Learn how to claim deductions correctly, comply with ATO regulations, and improve your bottom line. Understanding these deductions is crucial for financial health and minimizing your 2025 tax liability. We’ll cover key areas like home office expenses, vehicle costs, and staff wages, providing clear explanations and practical tips for small business tax deductions.

Office expenses are essential small business tax deductions covering the costs of running your workspace. These can include rent, utilities, supplies, and equipment. Claiming these deductions helps reduce your taxable income, which is crucial for maximizing profits. This category is fundamental because it offsets costs directly tied to business operations and productivity. For example, a freelance graphic designer could deduct home office rent and utilities, a law firm could claim office supplies and software subscriptions, and an online retailer could deduct warehouse space and packaging materials.

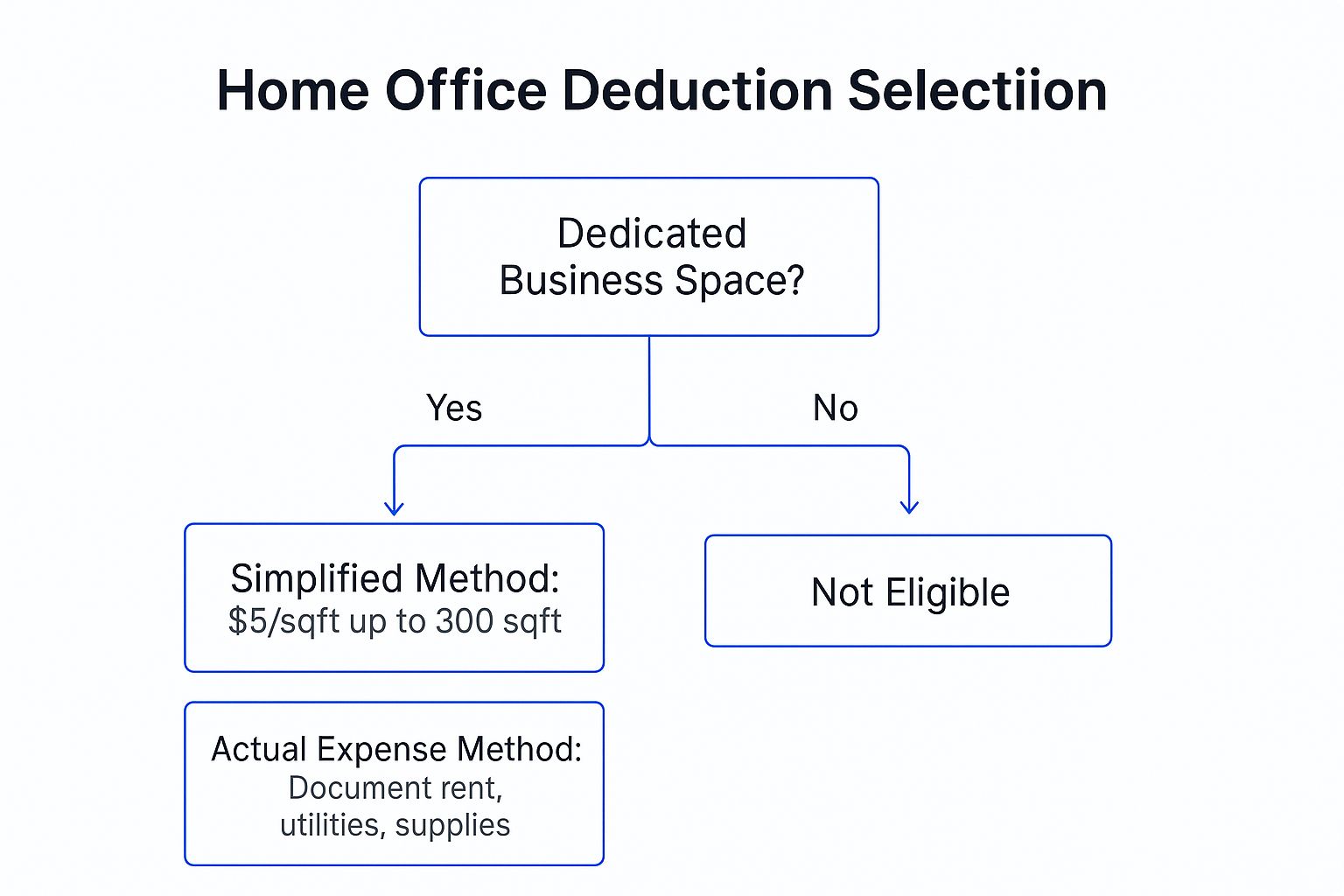

Choosing the right method for claiming your home office can significantly impact your tax savings. For simplicity, consider the simplified method of $5 per square foot up to 300 square feet. However, if your actual expenses are higher, meticulously tracking them could result in a larger deduction.

This decision tree infographic helps you choose between the simplified and actual expense methods for your home office deduction. The infographic clarifies the eligibility criteria for home office deductions and guides you towards the most beneficial method based on your specific workspace situation. Choosing wisely between these two methods can optimize your small business tax deductions.

Maintain meticulous records, including receipts for all office-related purchases. A dedicated business bank account simplifies tracking expenses and demonstrates a clear separation between personal and business finances. For home office deductions, photograph your setup to prove exclusive business use. Accurately calculate the business percentage of your utility bills for proper deductions. Consult with Nanak Accountants & Associates to ensure you’re maximizing your office expense deductions while staying ATO-compliant.

Vehicle and transportation expenses cover the costs of using vehicles for business purposes. These small business tax deductions include fuel, maintenance, insurance, and depreciation. Claiming these deductions can significantly reduce your tax burden, especially if you frequently use your vehicle for business. This category is valuable because it offsets costs directly related to business activities like client visits, deliveries, and site inspections.

For example, a real estate agent could deduct expenses for showing properties, a consulting firm could claim travel costs to client meetings, and a delivery service could deduct fuel and maintenance for its delivery vehicles. Small businesses can choose between the actual expense method or the standard mileage rate deduction, making this one of the most valuable tax deduction categories.

Use mileage tracking apps to automatically log business trips, ensuring accurate records for maximizing deductions. Keep a detailed logbook with the date, destination, purpose, and miles driven for each trip. Save all receipts for vehicle-related expenses if using the actual expense method. Carefully determine which method (actual vs. mileage) provides a better deduction before making your choice.

Maintain meticulous records of all vehicle and transportation expenses. This includes fuel receipts, maintenance invoices, insurance documents, and depreciation calculations. A dedicated business bank account or credit card simplifies expense tracking and demonstrates a clear separation between personal and business finances. Consult with Nanak Accountants & Associates to determine the best method and ensure ATO compliance.

Professional services and legal fees are small business tax deductions encompassing payments to attorneys, accountants, consultants, and other professional service providers directly supporting your business operations. These expenses are crucial for maintaining ATO compliance, obtaining expert advice, and supporting business growth initiatives. Claiming these deductions reduces your taxable income, maximizing profits and ensuring your business remains financially healthy. This category is essential for offsetting costs associated with expert guidance and legal compliance.

Ensure all professional services relate directly to your business operations. Request detailed invoices clearly outlining the specific services provided. For example, a startup could deduct legal fees for business formation and contracts, a restaurant could claim accounting services and tax preparation, and a manufacturing company could deduct regulatory compliance consulting.

Keep separate records for business versus personal professional services. Consider retainer agreements for predictable monthly expenses. Maintaining organized records helps substantiate your deductions in case of an ATO audit. Consult with Nanak Accountants & Associates to ensure you’re maximizing your professional services and legal fees deductions while remaining ATO-compliant.

Marketing and advertising expenses include all costs associated with promoting your business, building brand awareness, and attracting customers. This category has become increasingly important in the digital age, covering everything from traditional advertising to social media marketing and website development. Claiming these small business tax deductions reduces your taxable income, directly impacting profitability. This is crucial for businesses of all sizes, especially startups and small businesses looking to establish themselves in the market. For example, an e-commerce business could deduct Google Ads and Facebook advertising, a local restaurant could claim website development and social media management, and a professional service firm could deduct trade show participation costs.

Tracking your marketing ROI isn’t just good business practice; it also helps justify your expenses to the ATO. Keep meticulous records of all advertising contracts, invoices, and campaign performance data. This data-driven approach strengthens your deduction claims and helps optimize spending for future campaigns.

Maintain detailed records of every marketing and advertising expense. Keep invoices, contracts, and proof of payment. Separate personal social media costs from business marketing expenses. A dedicated business credit card or bank account simplifies tracking. Consult with Nanak Accountants & Associates to ensure your marketing and advertising deductions are ATO-compliant.

Business insurance premiums are essential small business tax deductions in Australia. These deductions cover the costs of protecting your business from various risks, including liability, property damage, and business interruption. Claiming these deductions reduces your taxable income, contributing to better cash flow. This category is crucial for mitigating financial risks and ensuring business continuity. For example, a consulting firm could deduct professional liability insurance, a retail store could claim general liability and property insurance premiums, and a tech startup could deduct cyber liability insurance and business interruption coverage.

Review your insurance coverage annually to ensure adequate protection and identify potential small business tax deductions. Keeping all policy documents and premium payment records is crucial for ATO compliance. Consider bundling policies for potential cost savings. Maintain separate business insurance from personal policies for clear deduction tracking.

Maintain meticulous records, including receipts for all insurance premium payments. A dedicated business bank account simplifies expense tracking. Consult with Nanak Accountants & Associates to ensure you are maximizing your business insurance deductions and adhering to ATO guidelines for the 2024-25 tax year.

Business meals and entertainment expenses cover costs associated with conducting business with clients, customers, or employees. Understanding recent tax law changes regarding deduction percentages is crucial for Australian small businesses. Maintaining proper documentation is essential for claiming these small business tax deductions. This category helps businesses offset the costs of relationship building and team development, which are important for growth and morale. For example, a sales team could deduct 50% of client meals, while an office might claim 100% of employee meal programs (check current ATO rules).

Proper documentation is paramount for claiming business meals and entertainment. Document the business purpose, attendees, and discussion topics for each meal. Keep detailed receipts showing the date, location, and amount. Separating entertainment costs from meal costs ensures accurate deductions according to ATO guidelines. Taking advantage of the 100% deduction for employee meals, where applicable, can lead to significant tax savings.

Maintaining impeccable records is crucial for ATO compliance when claiming these small business tax deductions. A dedicated business credit card simplifies tracking and categorization. Digital copies of receipts prevent loss and facilitate easy retrieval during tax time. Consult with Nanak Accountants & Associates for expert guidance on maximizing your deductions for business meals and entertainment while staying compliant with Australian tax laws.

Equipment and technology expenses are crucial small business tax deductions covering computers, software, machinery, and other tangible assets vital for your operations. These assets can be deducted immediately using Section 179 or bonus depreciation, or depreciated over time. This flexibility offers valuable tax planning opportunities for small businesses looking to minimize their tax burden and improve cash flow. For example, a marketing agency can deduct the cost of new computers and design software, while a manufacturing company can claim deductions for production equipment. Even home-based businesses can deduct the business-use percentage of technology purchases like laptops and printers.

The timing of your equipment purchases can significantly impact your tax savings. Consult with a tax professional to determine the most advantageous time to make significant equipment purchases based on your specific business circumstances and the prevailing tax laws. This strategic approach could lead to greater tax deductions and improve your overall financial planning.

Maintain detailed records of all equipment and technology purchases, including receipts, invoices, and warranty information. For items used for both business and personal purposes, maintain a logbook showing the business-use percentage to ensure ATO compliance. This meticulous record-keeping is essential for substantiating your deductions during tax audits and maximizing your small business tax deductions. Consult with Nanak Accountants & Associates to ensure you’re claiming the appropriate deductions.

Employee wages and benefits represent one of the largest deductible expense categories for small businesses. This includes salaries, wages, bonuses, and various employee benefits. Claiming these small business tax deductions is crucial for businesses with employees and offers opportunities for tax-advantaged employee compensation strategies. This category is essential because it offsets costs directly related to staffing and productivity. For example, a small retailer could deduct $120,000 in employee wages plus $15,000 in payroll taxes. A professional services firm could claim health insurance premiums and 401(k) contributions. A restaurant could deduct wages, tips, and workers’ compensation insurance.

Take advantage of tax-favored employee benefits such as superannuation contributions to minimize your tax burden while providing valuable benefits to your employees. This not only improves employee morale but also reduces your taxable income.

Maintain meticulous payroll records and tax filings. Ensure all compensation is reasonable and well-documented according to ATO guidelines. A dedicated business bank account helps track expenses and ensures proper separation of personal and business finances. Consider the timing of bonuses and benefit payments for potential tax planning advantages. Consult with Nanak Accountants & Associates to ensure you’re maximizing your employee wage and benefit deductions while remaining ATO-compliant.

| Expense Category | Implementation Complexity | Resource Requirements | Expected Outcomes | Ideal Use Cases | Key Advantages |

|---|---|---|---|---|---|

| Office Expenses | Moderate – record-keeping needed | Moderate – receipts, invoices, dedicated space | Significant tax savings if qualified | Small businesses, remote workers | High tax savings; home office deduction |

| Vehicle and Transportation | Moderate to High – mileage logs | Moderate – mileage apps, fuel receipts | Substantial deductions for travel-heavy businesses | Businesses with significant travel | Flexibility in method; covers wide costs |

| Professional Services & Legal Fees | Low to Moderate – documentation | Low to Moderate – invoices, contracts | Full deduction of ordinary business expenses | Businesses needing expert advice | Fully deductible; helps avoid costly errors |

| Marketing and Advertising | Moderate – tracking ROI & contracts | Moderate to High – campaigns and invoices | Boosts visibility and revenue potential | Businesses focused on growth and branding | Wide coverage; both traditional and digital |

| Business Insurance | Low to Moderate – policy management | Moderate – premium payments, documents | Essential risk protection, deductible | All businesses seeking risk mitigation | Fully deductible; protects business assets |

| Business Meals & Entertainment | Moderate – detailed documentation | Moderate – receipts, purpose logs | Partial deductions; supports relationships | Businesses with client/employee interactions | Helps business development; partial deductibility |

| Equipment and Technology | Moderate to High – depreciation rules | Moderate – receipts, use logs | Immediate or depreciated deductions | Businesses with significant capital purchases | Immediate expensing via Section 179 |

| Employee Wages and Benefits | Moderate to High – payroll compliance | High – payroll systems, benefits admin | Large deductible expense | Businesses with employees | Fully deductible; attracts and retains staff |

Mastering small business tax deductions is crucial for minimizing your tax liability and boosting your bottom line. Throughout this article, we’ve explored ten key deduction categories, from the commonplace (like office expenses and vehicle costs) to the often-overlooked (such as professional development and specific industry-related deductions). Remember, accurate record-keeping is paramount. The ATO requires substantiation for all claims, so maintain meticulous records of your expenses.

Taking advantage of legitimate small business tax deductions is essential for financial health. By understanding the nuances of each deduction, you can strategically manage your finances and optimize your tax position. Don’t leave money on the table – carefully review your expenses and ensure you’re claiming everything you’re entitled to. This careful approach can significantly impact your profitability and long-term success. In the complex landscape of Australian tax law, maximizing these deductions can provide a substantial financial advantage.

Successfully navigating these deductions requires a deep understanding of current ATO guidelines. Staying informed about changes in tax legislation is essential to remain compliant and avoid penalties. A proactive approach to tax planning, coupled with accurate record-keeping, can simplify tax time and provide peace of mind. Remember, each deduction represents an opportunity to reinvest in your business and drive future growth.

For expert guidance on maximizing your small business tax deductions in Australia, contact Nanak Accountants & Associates. We specialize in helping businesses like yours navigate the complexities of tax law and achieve financial success. Visit Nanak Accountants and Associates today for tailored advice and support to optimize your tax strategy for the 2024-25 financial year and beyond.

The information on this website is for general informational purposes only and should not be considered financial, taxation, or legal advice. While we strive for accuracy, Nanak Accountants does not guarantee the completeness or reliability of the content. Laws and regulations change over time, and we recommend consulting a qualified professional before making any financial or business decisions. Nanak Accountants is not liable for any loss or consequences arising from reliance on this information. For personalised advice, please contact Nanak Accountants directly.