Think of superannuation as a delayed salary, a safety net for your employees’ future. Unlike regular wages, it comes with strict rules and deadlines. Missed payments or incorrect calculations can result in hefty penalties.

So, understanding your superannuation obligations is critical from day one of hiring, regardless of whether your employees are full-time, part-time, or casual.

The scale of Australia’s superannuation system highlights its significance. The industry held a staggering $3.9 trillion in assets as of June 2024. This shows the considerable financial impact of employer contributions. Want to learn more about this growth? Check out this KPMG analysis.

Let’s delve into what these obligations mean for your business and how to manage them efficiently.

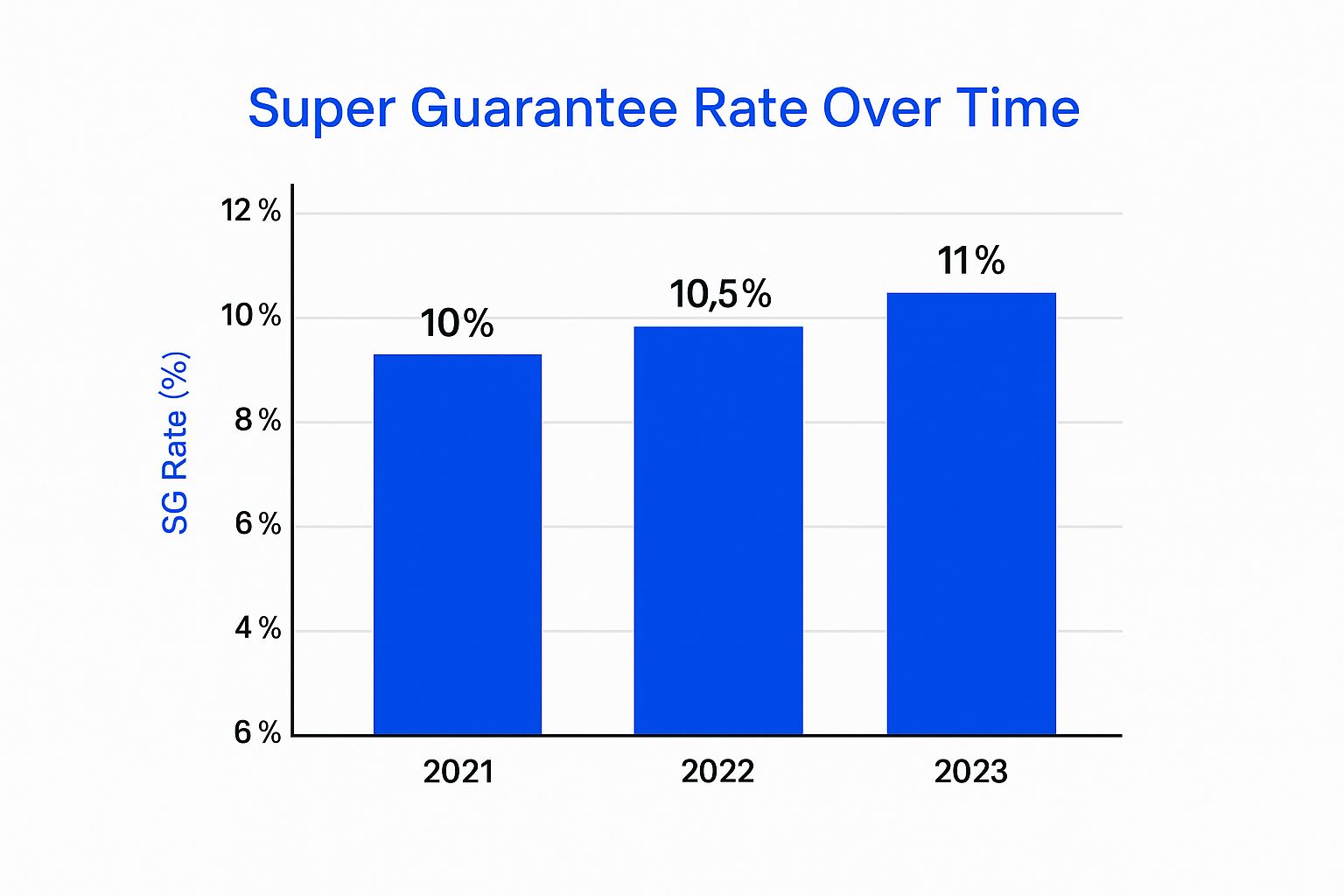

The chart above shows how the Superannuation Guarantee rate has been climbing over recent years. This highlights just how important it is to keep up with the current rate to make sure your calculations are spot on. The steady increase has a real impact on the contributions employers need to make.

Getting your employees’ Superannuation Guarantee (SG) contributions right might seem as easy as multiplying their earnings by the current 11.5% rate.

But it’s not always that straightforward. Think of it like baking a cake the basic recipe is simple, but adding different ingredients or changing the baking time can affect the final result. Similarly, things like specific allowances, benefits, and whether someone works full-time, part-time, or casually, all play a role in how you calculate SG contributions.

The SG rate, the minimum percentage of an employee’s salary that employers must contribute to super, rose to 11.5% in July 2024. This increase means employers are contributing more a total of $147.1 billion for the year ending March 2025, up 10.3% from the previous year. You can find more details on the superannuation statistics page.

Understanding these details is key to meeting your superannuation obligations and avoiding potential headaches with the ATO. Let’s look at a few real-world examples to make things clearer.

To help illustrate the calculation process, we’ve put together a table showcasing different employment scenarios. This table will break down how to calculate superannuation contributions for full-time, part-time, and casual employees.

SG Rate Calculation Examples By Employment Type: Practical examples showing how to calculate super contributions for different employee scenarios including full-time, part-time, and casual workers

| Employment Type | Monthly Salary | SG Rate (11.5%) | Quarterly Contribution | Annual Total |

|---|---|---|---|---|

| Full-time | $6,000 | 11.5% | $2,070 | $8,280 |

| Part-time (20 hours/week) | $3,000 | 11.5% | $1,035 | $4,140 |

| Casual (30 hours/week) | $4,500 | 11.5% | $1,552.50 | $6,210 |

As you can see, the SG contribution is calculated by multiplying the monthly salary by the SG rate. This amount is then multiplied by three to get the quarterly contribution, and by four to determine the annual total. Keeping track of these calculations is crucial for both employers and employees to understand their superannuation entitlements.

This screenshot shows the ATO’s key superannuation rates and thresholds, including the Superannuation Guarantee (SG) rate. It’s a handy snapshot for employers needing quick access to these important numbers. The clear layout makes it easy to find what you need.

Meeting your superannuation obligations means paying the right amount on time. The ATO sets strict quarterly deadlines, and unlike other business payments, there’s not much wiggle room. This is where having robust systems and processes becomes essential.

Imagine suddenly realizing a critical payment process has a glitch just days before the deadline. Stressful, right? This is why being proactive is so important. Setting internal deadlines ahead of the ATO’s official dates, having backup payment methods, and keeping meticulous records can save you a lot of headaches.

Think of it like this: if the ATO deadline is the 28th, aim to finalize payments internally by the 21st. This buffer gives you time to handle any unexpected hiccups. It’s like having a safety net.

Having a secondary payment method is also wise. It’s like having a spare tire in your car you hope you never need it, but you’re glad it’s there if you do. You don’t want to be stuck relying on a single system that could potentially fail.

To help you stay on top of these deadlines, here’s a handy table outlining the key dates and requirements:

Quarterly Super Payment Deadlines

Complete schedule of ATO super payment deadlines with key dates and compliance requirements for each quarter

| Quarter Period | Payment Due Date | Grace Period | SGC Applies From | Record Requirements |

|---|---|---|---|---|

| Quarter 1 (July 1 – Sept 30) | October 28 | (See ATO Website for details) | July 1 | Detailed records of contributions, earnings, and member details |

| Quarter 2 (Oct 1 – Dec 31) | January 28 | (See ATO Website for details) | October 1 | Detailed records of contributions, earnings, and member details |

| Quarter 3 (Jan 1 – Mar 31) | April 28 | (See ATO Website for details) | January 1 | Detailed records of contributions, earnings, and member details |

| Quarter 4 (Apr 1 – June 30) | July 28 | (See ATO Website for details) | April 1 | Detailed records of contributions, earnings, and member details |

Note: The table above provides a general overview. Always refer to the official ATO website for the most up-to-date information on grace periods and specific record-keeping requirements.

By treating super deadlines as non-negotiable and putting these strategies in place, you avoid penalties and maintain a good relationship with the ATO. This proactive approach is a key ingredient for long-term business success. It’s not just about compliance; it’s about peace of mind.

Missing superannuation payments isn’t just a minor paperwork problem. It can set off a chain reaction of financial consequences. The Superannuation Guarantee Charge (SGC) is there to protect your employees’ entitlements, but it can also put a serious dent in your business’s finances.

Imagine this: you miss an $8,000 quarterly super payment. That missed payment could balloon into a $12,000 SGC liability, plus the added sting of interest and administrative hassles. And even after you settle the SGC, you still owe your employees that original $8,000.

This section breaks down how SGC calculations work and the potential impact they can have. Getting your head around these calculations is a fundamental part of meeting your super obligations. Think of it this way: if you miss a deadline because of cash flow problems, you could end up creating a much bigger financial headache for yourself later on. A short-term cash flow issue leading to a missed payment can quickly snowball with the added SGC, putting unnecessary strain on your business.

Knowing how SGC is calculated is also crucial for accurate budgeting and financial forecasting. This isn’t about scaring you, but about giving you the knowledge you need to make superannuation payments a priority.

Australia’s superannuation system is only getting bigger. Projections show the sector holding a whopping $8.1 trillion in assets by 2035. That’s about 180% of GDP, a big jump from the current $3.9 trillion (around 150% of GDP). You can explore these future projections in more detail.

This growth highlights why staying informed and on top of your superannuation obligations is so important. The consequences of not complying go beyond just financial penalties. It can also damage your business’s reputation and the trust you’ve built with your employees.

Meeting your superannuation obligations isn’t just a compliance exercise; it’s about creating a system that integrates smoothly with your business operations. Think of it like setting up an efficient online banking system a little effort upfront saves you headaches down the line.

Today, smart businesses use technology to manage super. Integrating payroll software with super payment platforms eliminates manual data entry and those inevitable typos, gives you a clear view of your contributions, and frees up your time to focus on growing your business. Imagine your payroll automatically calculating and scheduling super payments each quarter, that’s the efficiency technology offers.

Selecting a suitable default super fund is another key piece of the puzzle. It simplifies the onboarding process for new employees and reduces your administrative workload. A good default fund offers a range of solid investment options, communicates clearly with your employees, and keeps everyone happy while simplifying your superannuation responsibilities.

Imagine an ATO audit not as a stressful event, but as a simple check-in. Meticulous record-keeping makes this possible. Maintaining accurate records of contributions, payment dates, and employee fund choices turns a potential headache into a straightforward review. This is where cloud-based storage and digital record-keeping shines. We can help you ensure your record-keeping is up to scratch.

Even the best systems can sometimes experience glitches. Wise businesses have backup plans, like manual payment options and open communication channels with their default fund. This ensures super payments stay on track, even if there are technical hiccups. These fail-safes demonstrate your commitment to meeting your superannuation obligations and build trust with your employees, minimizing stress when the unexpected happens.

Even the most experienced business owners can sometimes stumble into common superannuation pitfalls. These oversights, often glaringly obvious after the fact, can easily get lost in the everyday hustle of running a business. Think of it like forgetting to water a plant, it’s a simple task, but if overlooked, can have significant consequences.

One common trap is contractor misclassification. It’s easy to assume someone is a contractor, but the ATO might see them as an employee. This can trigger unexpected backdated superannuation obligations – imagine suddenly having to pay months or even years of missed super!

Another frequent mistake is overlooking super on non-standard payments. Many businesses diligently pay super on regular salaries but forget about other types of compensation. Think about bonuses, commissions, or even those holiday gift cards. These perks often attract superannuation obligations too. For example, if you’re handing out Christmas bonuses, you need to remember the extra super that goes with them.

Salary Sacrifice Miscalculations: Imagine your employee’s salary is $5,000 and they sacrifice $1,000 to super. A common error is calculating super on the reduced $4,000 salary. Instead, you should calculate it on the original $5,000 pre-sacrifice amount.

The $450 Threshold Misunderstanding: The $450 monthly earnings threshold for employees under 18 applies per employer. If a teenager works two jobs earning $400 at each, super is payable by both employers, even though neither individually pays over $450.

Ignoring Employee/Contractor Hybrids: Sometimes, an employee might also do some work as a contractor. Even with this mixed arrangement, you still need to pay super for the hours they work as an employee.

Navigating these situations can feel like walking a tightrope, but with a clear understanding of your superannuation obligations, it becomes much easier. Recognizing these common pitfalls is the first step towards avoiding costly penalties and maintaining a good relationship with the ATO. It’s like checking the map before a road trip a little preparation can save a lot of headaches down the line.

Turning your superannuation obligations from a headache into a real business asset begins with looking at your current practices. It’s a bit like getting your car serviced – you’re checking for potential problems before they cause a breakdown. We’ll give you practical checklists to help you spot areas for improvement so you can tackle the most urgent compliance gaps first.

Imagine you’re a doctor treating a patient. You’d focus on the most critical issues first, right? With super, that means ensuring payments are made on time and your Superannuation Guarantee (SG) calculations are accurate. While you’re dealing with those immediate needs, you also want to build long-term systems for sustainable superannuation compliance. Think of it as preventative care – a little effort now avoids bigger problems later.

Meeting your superannuation obligations isn’t just about dodging penalties. It’s a great way to attract and keep good employees. People appreciate a company that invests in their future. Being compliant builds trust and shows you care about your team’s financial well-being, which can give you an edge when you’re trying to hire the best talent.

Superannuation can be tricky. Getting professional advice can be really helpful, especially if you’re dealing with unusual situations or the ATO. Think of advisors as expert navigators who can help you understand the complexities of superannuation law. They can help create a plan that’s tailored to your business and keep you up-to-date with changes in regulations.

Getting your superannuation systems running smoothly takes time, but we’ll lay out realistic timeframes and milestones so you can track your progress. We’ll also point you to key resources for keeping up with ATO requirements, and help you find specialized professionals if you need them. By taking these next steps, you can turn superannuation management from a chore into a strategic asset for your business.

Ready to simplify your super and focus on growing your business? Contact Nanak Accountants and Associates today for expert advice and support. Learn more about how we can help you manage your super obligations.

The information on this website is for general informational purposes only and should not be considered financial, taxation, or legal advice. While we strive for accuracy, Nanak Accountants does not guarantee the completeness or reliability of the content. Laws and regulations change over time, and we recommend consulting a qualified professional before making any financial or business decisions. Nanak Accountants is not liable for any loss or consequences arising from reliance on this information. For personalised advice, please contact Nanak Accountants directly.