Imagine giving your future self a financial high-five while also giving your current self a tax break. That’s the magic of salary sacrificing into your super. Think of it like diverting a portion of your pre-tax earnings directly into your superannuation fund.

This means a little less money lands in your bank account each payday, but more goes towards a comfortable retirement, and it’s taxed at a sweeter rate. Instead of the usual income tax you pay on your salary, super contributions are taxed at a much lower rate within the super fund itself.

This strategy is gaining traction, especially among those earning mid-to-high incomes in Australia. It’s a savvy way to take charge of your financial future and grow those retirement savings. Salary sacrificing is a major avenue for Aussies looking to boost their super, with substantial contributions being made every year.

In fact, recent superannuation statistics reveal that salary sacrifice contributions hit about AUD 2,129 million in March 2025. Discover more insights about superannuation contributions. That shows the real impact this can have on your long-term financial well-being. Later on, we’ll explore some real-life examples of how salary sacrificing can work for you.

Putting money into your superannuation through salary sacrifice might sound complicated, but it’s surprisingly simple. Think of it like setting up a regular direct debit to pay a bill, except instead of going to your phone company, the money goes straight into your super.

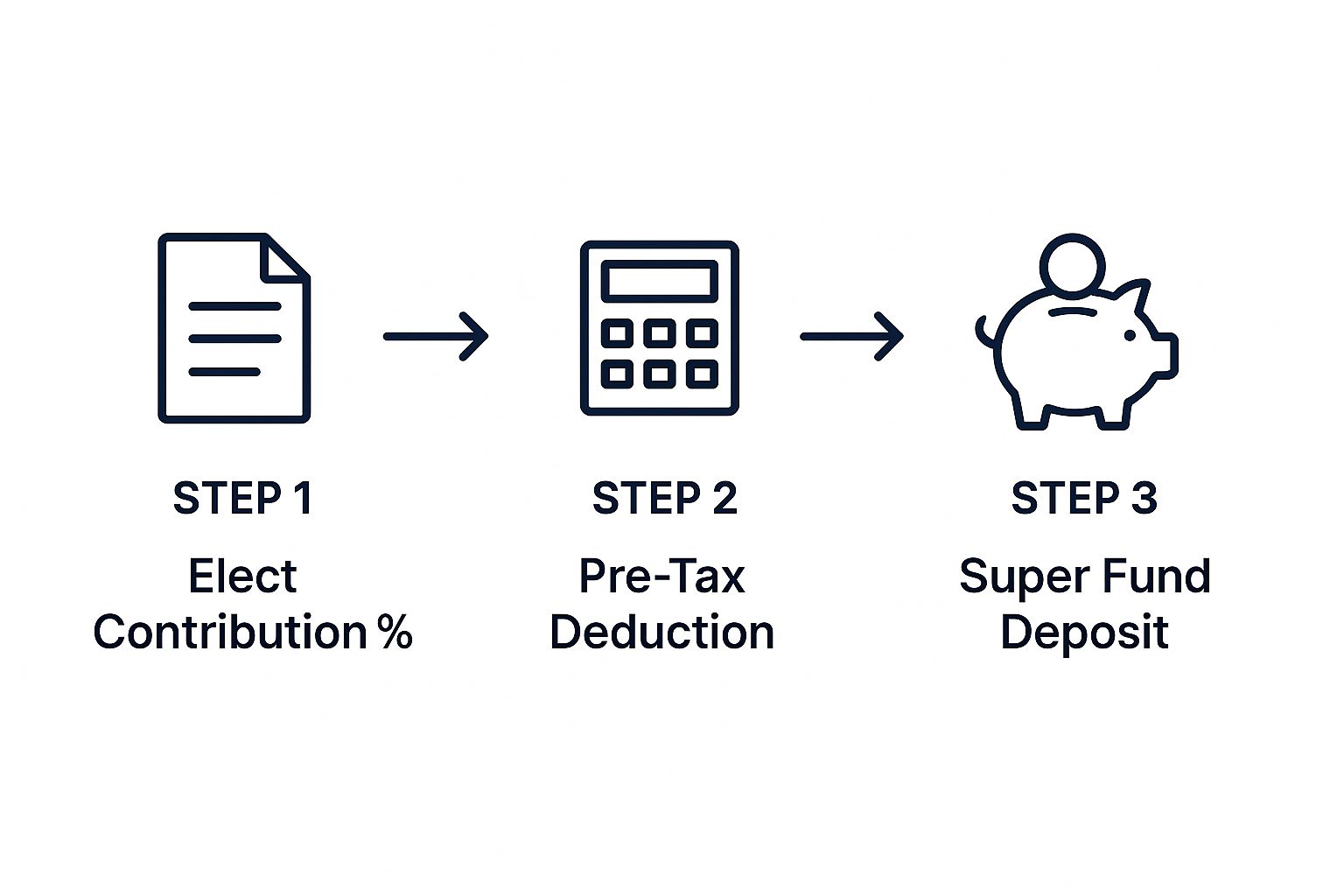

The image below shows the three key steps.

First, you choose what percentage of your pre-tax salary you want to contribute. This amount is then deducted from your pay before you even see it. Finally, this deduction lands directly in your super fund. It’s a behind-the-scenes system that steadily grows your super over time.

Let’s look at an example. Imagine you earn $80,000 a year and decide to salary sacrifice 10%. That’s $8,000 going into your super. Your take-home pay then becomes $72,000. The important part is that the $8,000 in your super is taxed at the concessional rate of 15%. This is usually much lower than your regular income tax rate.

The difference between your slightly lower take-home pay and the larger amount going into your super represents your immediate tax savings. This makes salary sacrifice a helpful strategy for managing your taxes as part of your overall financial plan.

To help illustrate the difference between a regular salary and salary sacrificing, let’s look at the following table:

Salary Sacrifice vs Regular Salary: Tax Comparison

A side-by-side comparison showing tax implications of receiving salary vs salary sacrificing the same amount assuming a 37% marginal tax rate.

| Scenario | Taxable Income | Tax Paid | Super Contribution | Take-Home Pay | Total Benefit (Take-Home Pay + Super Contribution) |

|---|---|---|---|---|---|

| Regular Salary | $80,000 | $29,600* | $0* | $50,400* | $50,400* |

| Salary Sacrifice 10% ($8,000) | $72,000 | $26,640 | $8,000 | $45,360 | $53,360 |

* These figures represent illustrative calculations and are not financial or legal advice. Individual circumstances vary. For clarity, we have ignored the superannuation guarantee contributions that your employer might make.

As you can see, even though your take-home pay is slightly less with salary sacrifice, the overall benefit, including the money in your super, is higher.

You can learn more about tax planning on our Tax Planning page. The Australian Taxation Office (ATO) also has helpful resources on salary sacrificing super.

Salary sacrificing into superannuation comes with some compelling tax advantages. These aren’t just abstract savings; they put real money back in your pocket, helping you build a bigger retirement nest egg. Let’s explore how these benefits become even more powerful as your income grows.

Imagine two colleagues: one earning $65,000 a year and the other $110,000. The higher earner is in a higher tax bracket. This means a bigger chunk of their income is taxed at a higher rate. By using salary sacrifice, they effectively move part of their income into the lower-tax super environment.

This shift can lead to significant tax savings, especially compared to someone in a lower tax bracket.

Let’s say both colleagues salary sacrifice $5,000. The higher earner will save more in tax because they’re avoiding that higher marginal tax rate. This illustrates how salary sacrifice becomes increasingly valuable as you earn more. It’s a helpful strategy to combat bracket creep, where pay rises push you into a higher tax bracket, reducing your take-home pay.

The tax benefits don’t stop at immediate savings. The money in your super fund grows over time, benefiting from the power of compound interest through investment returns. This compounding, combined with the lower tax rate within super, can significantly boost your final retirement balance.

To illustrate the potential savings, let’s look at a simplified example.

Let’s look at the potential tax savings across different income levels. The table below provides a simplified illustration, assuming a $5,000 salary sacrifice and a 15% superannuation tax rate. Keep in mind, individual circumstances and actual tax rates will vary. Consult a financial advisor or the ATO for personalized advice.

| Annual Income | Marginal Tax Rate | Tax on $5,000 Salary | Tax on $5,000 in Super | Annual Savings |

|---|---|---|---|---|

| $50,000 | 32.5% | $1,625 | $750 | $875 |

| $90,000 | 37% | $1,850 | $750 | $1,100 |

| $180,000 | 45% | $2,250 | $750 | $1,500 |

This table demonstrates how the tax savings increase as income and the marginal tax rate rise. While this is a simplified example, it highlights the potential benefits of salary sacrifice.

You can find more detailed information about superannuation tax here. For personalized advice on maximizing your super, contact us at Nanak Accountants. The ATO also provides comprehensive information about salary sacrificing on their website.

This screenshot from the ATO website shows the contribution caps for the 2024-25 financial year. Think of these caps like the fill line on a gas tank, you don’t want to overfill it.

Understanding these limits is key to making the most of your salary sacrifice strategy. The concessional contributions cap is $30,000. This includes everything from your employer’s contributions to the amount you choose to salary sacrifice.

Going over this $30,000 limit can lead to extra taxes, which defeats the purpose of salary sacrificing in the first place. It’s like trying to save money by buying something on sale, only to get hit with a huge delivery fee.

Staying within the limits means keeping a close eye on your contributions. Luckily, tools like myGov let you track your contributions in real-time.

Think of it as checking your bank balance regularly to avoid overdraft fees. It’s always better to be proactive!

Also, staying in contact with your payroll department ensures accurate record-keeping. They can help you adjust your salary sacrifice arrangements, which can prevent any nasty tax surprises down the line.

For more complicated situations, a tax agent can provide personalized guidance. They can help you navigate these rules and optimize your strategy within the ATO’s guidelines. You can find more information on our superannuation tax page and the ATO website.

Thinking about how to boost your super? Choosing the right contribution strategy makes a real difference down the line. Both salary sacrifice (concessional contributions) and personal after-tax contributions (non-concessional) help grow your nest egg, but they work a bit differently when it comes to tax.

Think of salary sacrifice like pre-paying for groceries at a discount. You’re setting aside some of your pre-tax income and sending it straight to your super fund. This money gets taxed at a lower rate – a maximum of 15%, which can lighten your overall tax burden.

Personal after-tax contributions, on the other hand, are like buying groceries with money you’ve already paid tax on. No upfront discount, but the good news is, once this money is in your super fund, it grows tax-free.

So, which approach is right for you? If you’re employed and eligible for salary sacrifice, it can be a great way to reduce your current tax bill. Imagine getting a small tax break every payday, that’s essentially what salary sacrificing can do. Learn more about the specifics at the ATO website.

What if your employer doesn’t offer salary sacrifice, or you’re self-employed? This is where personal after-tax contributions shine. They offer flexibility and control, you decide how much and when to contribute.

There’s also a hybrid option: personal deductible contributions. These are made after tax, but you can claim a tax deduction, similar to salary sacrifice. It’s like getting a refund on those groceries later on. And don’t forget the government co-contribution scheme. For eligible lower-income earners, this is essentially free money from the government to boost your super savings. Think of it as a bonus coupon for your grocery shopping. Our Superannuation Tax page has more details on these strategies.

Combining these strategies wisely can help you optimize both your tax and super balance. Ready to create a personalized plan? Contact us at Nanak Accountants. We’ll help you build a strategy tailored to your unique financial goals.

Successfully navigating salary sacrifice requires careful planning. Think of it like planning a road trip, you wouldn’t just hop in the car without a map or a destination in mind, right? Similarly, with salary sacrifice, you need to know where you’re going (your retirement goals) and how to get there (a solid strategy).

Mistakes, even unintentional ones, can lead to penalties and missed opportunities. A common trap is exceeding the concessional contributions cap, currently $30,000. This cap is like the speed limit on your road trip going over it can result in a costly fine (in this case, excess contributions tax), wiping out the tax benefits you were aiming for. This cap includes your employer’s Super Guarantee contributions and any salary sacrifice amounts, so it’s important to keep track of both.

Changing employers mid-year adds another layer of complexity. Imagine switching drivers mid-road trip, it can make navigating a bit more challenging. Multiple employers contributing to your super can make it tricky to track your total contributions, increasing the risk of going over that $30,000 limit.

Another crucial factor is the impact on your take-home pay. While salary sacrificing does reduce your tax bill, it also reduces your net income. Think of it like choosing a scenic but slightly longer route, you’ll enjoy the views (tax savings), but it might take a bit longer to get there (less money in your pocket each payday). This can affect your borrowing power for things like mortgages or other financial commitments.

Careful planning and open communication with your employer are essential. Regularly reviewing your contributions via myGov is like checking your map throughout your road trip to make sure you’re still on the right track. Additionally, discussing your salary sacrifice strategy with your employer, especially if you receive bonus payments, is like getting clear directions before you set off. This ensures correct calculations and helps avoid exceeding the contribution cap. Learn more about managing your super contributions. Professional advice from Nanak Accountants can help you optimize your approach and stay compliant, just like a seasoned travel agent can help you plan the perfect trip.

Building a successful salary sacrifice strategy isn’t one-size-fits-all. It’s like tailoring a suit – you need the right measurements and adjustments for the perfect fit. It’s about finding that sweet spot between boosting your super through tax benefits and handling your other financial goals.

Do you have high-interest debt? Saving for a house? These things impact how much you can comfortably salary sacrifice. For example, if you’re tackling debt head-on, a smaller salary sacrifice might be wiser. Need help managing debt? Check out our Tax Planning page.

Your career stage and income also matter. Early on, even small, regular contributions can grow significantly thanks to the magic of compounding. As your income increases, you can adjust your contributions, keeping the annual concessional contributions cap in mind. Breaching this cap can result in penalties, as we discussed earlier.

Life throws curveballs a new family, a pay raise and these often require tweaking your strategy. Regularly reviewing your salary sacrifice arrangements, maybe yearly or after big life changes, is important. It’s like recalibrating your compass when your path changes.

This involves keeping tabs on your contributions throughout the financial year, ideally using online tools like myGov, and staying in touch with your payroll department. For more details on contribution caps and ATO compliance, visit the ATO website.

A financial advisor or tax professional can offer personalized guidance and ensure your strategy is optimized. Contact Nanak Accountants and Associates today for expert advice. We can help you build a salary sacrifice strategy that works in harmony with your overall financial plan, setting you up for a secure and comfortable retirement.

The information on this website is for general informational purposes only and should not be considered financial, taxation, or legal advice. While we strive for accuracy, Nanak Accountants does not guarantee the completeness or reliability of the content. Laws and regulations change over time, and we recommend consulting a qualified professional before making any financial or business decisions. Nanak Accountants is not liable for any loss or consequences arising from reliance on this information. For personalised advice, please contact Nanak Accountants directly.